by Wine Owners

Posted on 2021-10-13

By Miles Davis

Welcome back, I hope you all had a lovely summer. I did not; being confined to UK holidays this year, I was devoid of any real sunshine, so thank the heavens for the wine market! The climate in the wine market is just about perfect at the moment; not too hot, but nice and warm with the odd blistering day. No storms around too, it’s just lovely, so we wonder how long this can last?

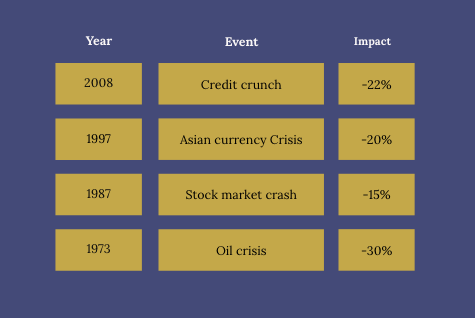

For this question, we turn to our history books; the major corrections in the wine market have come on the back of macro events. In the 70s it was the oil crisis (when the brewer Bass Charrington dumped hundreds of cases (of 12) of Mouton Rothschild at sub £100 a case, apparently), in the 80s it was the ’87 stock market crash, the 90s the Asian currency crisis in ’97, and in the noughties of course it was the ‘Credit crunch’, as we call it in the UK, the global financial crisis in other quarters. When these events happened, obviously long before screen prices were commonplace, panic selling ensued, and prices were marked down. In reverse order:

Some may notice I haven’t included the great sell off that commenced in 2011, lasting until 2016, the market falling c.30% in the meantime. That is because it was not a market wide phenomenon, it only applied to the red wines of Bordeaux, which admittedly, had been over 90% of the market back then. It is now 35-40%. Neither had it been caused by a macro event, but by the anti-graft campaign led by the new Chinese President Xi Jinping. This was also why it was a very long and drawn-out correction which, in my view, we are only coming out of now, a decade later. The ‘Red Obsession’ (did anyone see the film? A most enjoyable trailer can be enjoyed here. It could have been called ‘Top of the market’!) became the ‘Red Depression’ and Bordeaux was left languishing, casting a long shadow over the industry.

That depression had been caused by hyper price inflation (c.2005-2011), and a massive imbalance of supply over genuine demand. The explosion of one-tracked dodgy ‘investment specialists’ compounded this problem also. I am pleased to report that this market is not burdened with either of these same elements today.

There is a new wave of investor about, however, but a far more sophisticated breed. The type that conducts research, employs science, looks further afield than just the obvious and is making more and more of the market investible by helping to create a sturdier secondary market. The greater breadth and depth of the market is to be welcomed as this lends itself to a greater number of opportunities with a more diversified risk profile.

So, without the over-inflated price levels, except for Burgundy perhaps (but that is another story), without the cold calling clan, and with a more diversified market it will take a global crisis to slow this tanker down.

The old-fashioned tenet prevalent in the world of fine wine of limited supply set against ever increasing demand is back, and it is working well.

It is also worth noting that recent negative events, particularly the outbreak of Covid 19, only caused the market to draw breath rather than correct. I read this as another pointer to the market maturing; overpriced wines still go down but there is no need for sharp mark downs.

The Knight Frank Luxury Investment Index* received a lot of media coverage recently, reaching the national press; Decanter covered it here. Fine wine (+13%) outperformed other luxury assets such as watches (+5%), cars (+4%), art and jewellery but none of these numbers are overly demanding.

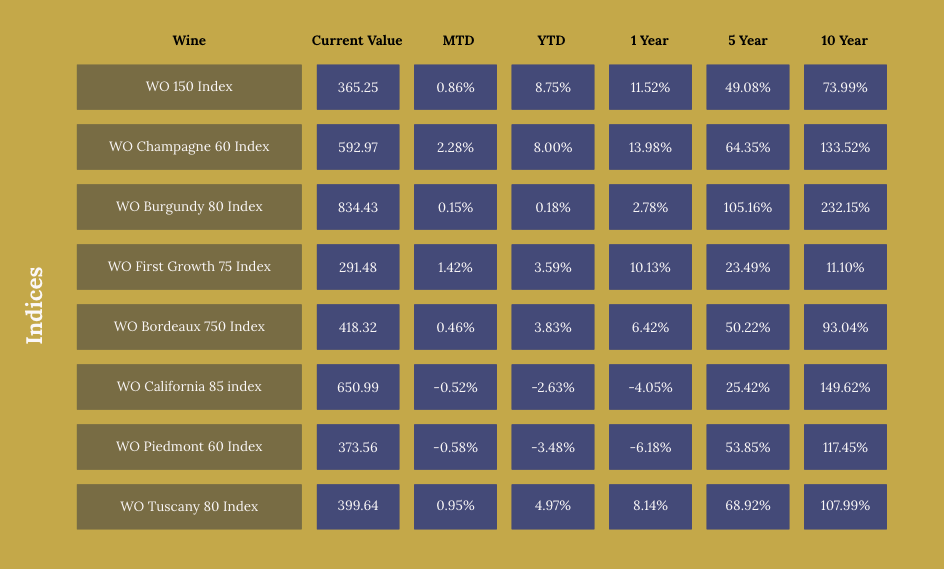

On a less macro level, Burgundy and Champagne are currently leading the charge but the Rhone, Bordeaux, most of Italy and the Rest of the World are all travelling nicely.

If you would like to discuss this, your own portfolio or anything else related, please feel free to call me.

Miles Davis, 07798 732 543

*Wine price data supplied by Wine Owners

Posted in: on 2021-10-13.

Tags: