by Wine Owners

Posted on 2019-04-16

Italia! From the the country that has given us espresso and cappuccino, ciabatta and focaccia, minestrone and spaghetti, Maldini and Rossi, Pavarotti and Verdi, Canaletto and Leonardo da Vinci, Ferraris and Maseratis, Bunga Bunga, the Mafia and the Pope, we now have… un'opportunità di investimento – nel mondo del vino!!

The Italians are not only the largest wine producing country in the world, they have been making wine for over four thousand years and cultivate over two thousand grape varieties on a multitude of different soils in twenty different regions! They are not bad at food either. Their climate seems to suit most of the finer things in life.

Italian wine being recommended is nothing new, but having it recommended as a collectable asset bearing an investment case is another matter. Ten years or so ago, a few canny collectors realised some of the ‘Super Tuscans’ (red wines typically made of a Bordeaux blend in Tuscany) such as Masseto, Ornellaia, Sassicaia (see recent blog post) and Solaia were ripe for decent returns. Traditionalists were a bit put out by these glossy new pretenders turning up on the Italian wine scene with their fancy French grape varieties and lots of marketing but it is fair to say they have helped the overall attention given to Italy and, as a result, the ‘Bs’ are blossoming – namely, Barolo, Barbaresco and, to a lesser extent, Brunello.

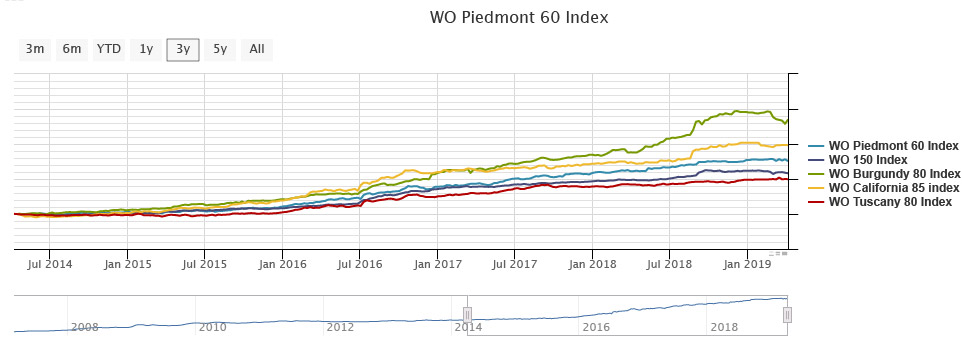

Wines from the best producers of Italy’s most venerable regions have been collected by the cognoscenti for years but now their appeal is becoming more widespread. The problems of Bordeaux, following an explosive China-driven period, have been well documented in the last decade and although we are quietly confident on a comeback from the sleeping giant, the smaller top-quality regions have been profiting. The indices for cult Californian (+98%) and beautiful Burgundy (+135%) have both gone berserk in the last five years, whilst Piedmont has gained a more modest 78%, with Tuscany posting +50%.

The reason for Burgundy and California’s performance is that old tried and tested wine world fundamental of demand outstripping supply - who knew!?? Both these regions produce tiny quantities in comparison to the number of people looking to access these markets and gain exposure. The complex nature of these regions with tiny vineyards, often co-owned by different families and winemakers, has added to the gloss and mystery, spurring on newcomers to learn more and invest time and money accordingly. More of the written word is more easily accessible to interested folk, and with platforms such as Wine Owners to trade on, the visibility of the product and the liquidity of the commodity has increased.

Grand Nebbiolo from Piedmont is yet to hit the big time, apart from a few, but there are more than rumblings in other names; dedicated collectors and the inquisitive are homing in. It is a Burgundian-like network of vineyards, producers, families and reputations and you need to know what you are doing. Famous names like Conterno, for example, have six listings in my favourite reference book: Aldo, Diego, Fantino, Franco, Giacomo (the big one) and Paolo.

Some of the bigger names like Giacomo Conterno famed for his Montfortino vineyard, Giuseppe Rinaldi, famed for Brunate and Tre Tine, Bartolo Mascarello and Gaja are already highly sought after superstars with prices to match but there are a host of others with reputations and demand beginning to swell; Brovia, Cappellano, Fratelli Alessandria, Sandrone, Voerzio and Vietti to name a few.

The ‘Super Tuscans’ of Bolgheri are much simpler to understand, like Bordeaux versus Burgundy, and are produced in larger numbers. The names mentioned earlier are virtually household names (in wine terms!) and are less exciting right now overall. Brunello di Montalcino, made from Sangiovese, is also comparatively easy to piece together in relation to Piedmont. Biondi Santi, Poggio di Sotto, Salvioni and Soldera are the big names with the fancy price tags. The secondary market for Brunello has not yet developed so, for now at least, it is a case of keeping a watchful eye.

There have been some excellent vintages in the last decade or so, attracting fantastic media coverage and battle-weary Bordeaux buyers. Another reason for favouring Italian wines in the current climate is that the U.S. and Germany are the biggest export markets, so unlikely to be affected by any potential fallout from Brexit. Most of all, however, these wines are barely scratching the Asian surface as yet and we all know what happens when that changes!

Posted in:

Fine wine analysis, on 2019-04-16.

Tags:

fine wines, Italian wine, italy,