by Wine Owners

Posted on 2022-02-03

As eagerly anticipated as the Sue Gray report, here it is, the annual WO round up and look ahead.

So, what happened?

2021 turned out to be a very good year for the wine market, the owners of wine and therefore for Wine Owners Ltd. also. Turnover on the exchange ramped up by 77% in 2021, producing more buying and selling opportunities than ever before! Our tenth year of trading is set to be an exciting one and has started well.

The broad based WO150 Index returned +15% with the stars of the show being Champagne and Burgundy, posting respectively +30% and +27%. Bordeaux returned a more modest 10% while Italy, having led the charge in 2020 came in with more modest numbers, yielding 6.5%. Tuscany performed better than Piedmont which was flat on the year. The Rhone did well, notching low double figures and the Rest of the World was twice as good as that, all thanks to California.

The reasons for the strength in the market were various; probably the biggest two were continued liquidity being pumped into the system in a low interest environment pushing more buyers into real assets, and the very real fear of inflation. Savings derived from staying at home more seems to have pushed up the spend on what people have been consuming at home – a quality driven drowning of sorrows in yet another lockdown!? The lifting of U.S. tariffs on some European wines brought a weight of new buying activity from across the pond, as did a lot of ‘new wave’ investment dollars - this should not be underestimated.

The market pre Covid had been largely stifled by various different factors but once demand started to outstrip supply, the market started to motor. Hong Kong and China were not responsible (for once) and collectively have been less of a force in recent times. Stringent lockdowns and border controls have meant very few visitors, especially of Mainland Chinese to Hong Kong, and an exodus of wealthy residents seeking a more liberated culture – some of the demand is moving elsewhere. Current thinking is that will last for some time (not just until after the Winter Olympics!), so be warned. I would expect Singapore to take up some of the slack and become a more prominent player.

Champagne

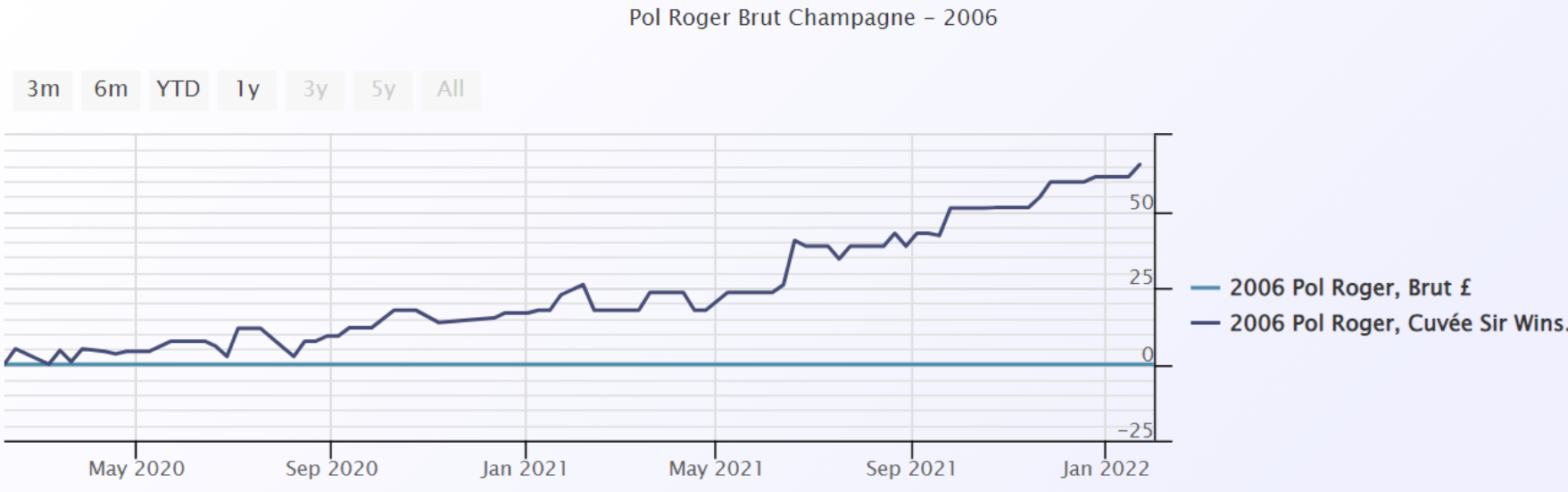

I cannot remember Champagne ever being the star turn in the wine market before but given the cyclical nature of the market and the fact that the different regions are much more equal than they used to be, it is not surprising. It has also consistently delivered steady returns, see my report from last July, just before the market really accelerated. Reports of supply shortages coming out of the region and a slew of really good quality releases added further weight to the concept of Champagne as an investment proposition which led to some voracious buying activity. The Champagne Index is dominated by the biggest names and/or the tête de cuvée of noble producers. As ever, fine wine collectors and investors focus in on the most prized assets driving the gap between the seriously good and the seriously a little bit better than that ever wider. Here’s a good example, vintage Pol Roger ’06 versus the Sir Winston Churchill cuvée from the same year:

The ‘simple’ vintage Champagnes from good producers offer extremely good value to drinkers and is a segment of the market that has been left behind.

Where Champagne goes from here is one of the big questions as some of the recent returns have been enormous. Various vintages of Krug, Dom Perignon, Taittinger’s Comtes de Champagne, Pol Roger’s Winston Churchill have added more 50-100% in the last year and rosé Champagne has been bought in a way not seen before. I am tempted to take some profit from some of the biggest risers and look for some laggards.

Burgundy

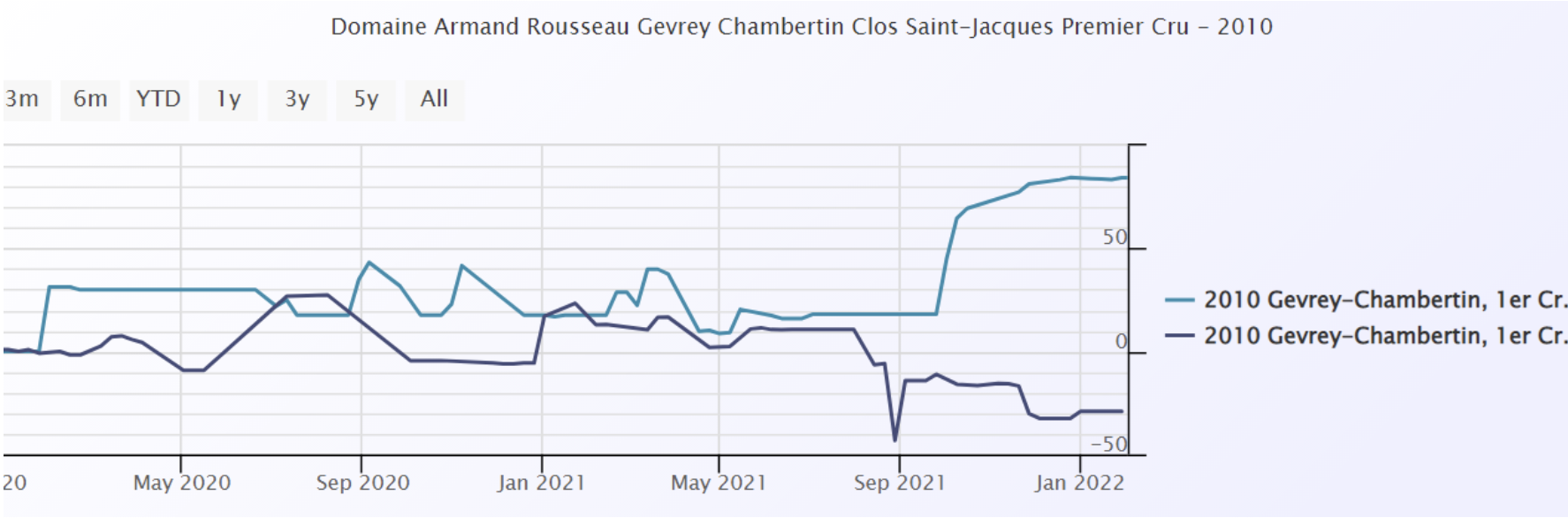

The polarisation of the wine market and the premiums attached to the most desirable names have continued to grow and probably make less sense than ever before. Names such as Leroy, DRC and Rousseau in Burgundy have outperformed their neighbours and as highlighted in some of our recent offers, often trade at multiples of equally high scoring wines from the same vineyards but from less famous producers. Obviously, this creates opportunity and I feel more comfortable making bets at the prices that are a fraction of the big guys. Here is a comparison between Armand Rousseau’s Clos St. Jacques (light blue) versus Bruno Clair’s. This sort of chart can be repeated numerous times - premiums have become too large for my liking, but if Rousseau is your man and you have the cash….

The current shortage of 2020 red Burgundy and the general short supply frost hit ’21 vintage, see report from last November, will push prices and demand ever higher and whilst some price performances seem overly vertiginous, I anticipate they will continue their path – for now at least. High rollers love spending big on Burgundy and the small production levels really adds the glitter dust to this famous region. And there are always the producers that are beginning to make a name for themselves.

Bordeaux

Bordeaux had a decent year, posting +10%. Apart from a brief flirtation with the 2019 en primeur release, Bordeaux has not been sexy for a very long time now. Market share continues to fall as other regions eat into the Bordelais’ gateau. It is still, and always will be, the largest slice of the market and those who buy into the general wine argument and need liquidity are best allocating here. It has become the steady Eddie. As a massive generalisation you know what you’re getting in your glass with a Bordeaux; a lot of that infuriating yet bewitching and beguiling wonder of what to expect from your wine just doesn’t exist in the same way that it does with Burgundian Pinot or Piedmont’s Nebbiolo and passionate collectors are just not quite so aroused by its charms (as I said, a generalisation!). I expect it to remain firm however.

Italy

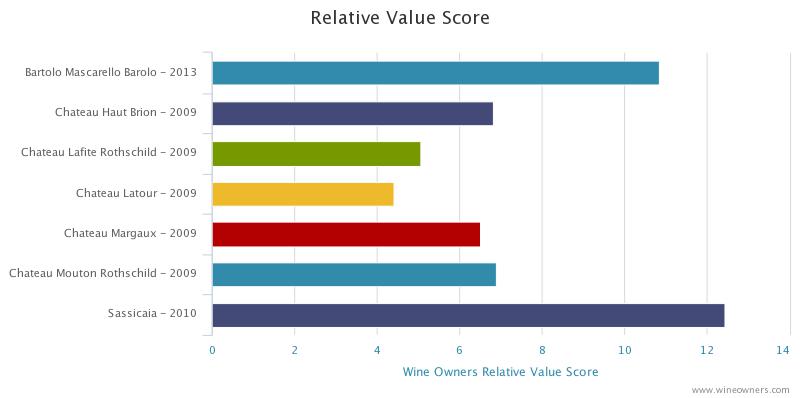

Italy has had a mixed year. Super Tuscany has done well, the massive names of Sassicaia, Tignanello and Masseto have continued to shine posting average gains in the region of 25%, 35% and 25% respectively, and Solaia and Ornellaia also, but not so brightly. Lots of smaller Brunelli have fared quite well and this sector continues to build – hardly surprising given the price to quality ratio. Piedmont has had a mixed time, Monfortino in general is up a little in most vintages but lots of big names across the region have remained unchanged. I would not be surprised to see interest return to this area once Burgundy’s current run has blown through. There are still numerous 2016s looking very interesting for the longer term.

The Rhone

The Rhone valley is more appreciated than ever before. There are numerous cult producers all over Cote Rotie, Hermitage, Cornas with St. Joseph coming to the party nowadays. Prices of Rayas product from down south have travelled to the far north as collectors chase these rare treasures. White Rhone is still very much a speciality interest but one to keep an eye on. I have bought a lot of red Rhone for drinking from the WO platform in the last year or so as the combination of maturity, quality and price is virtually impossible to beat. There are plenty of names delivering superior returns too.

The Rest of the World

California has dominated the remaining regions with some ease, posting over 20%. Screaming Eagle has led the pack, followed by Ridge and Dominus. Australia has suffered at the hands of China’s tariffs.

Conclusion

I am confident the market will continue to perform well this year. Sentiment is strong, and supply in some key areas is shorter than usual, especially Burgundy. The inflation fear mentioned earlier is real and wine has been seen as a good hedge against this for a long time now. Interest rates are likely to rise but remain historically low and the real asset argument holds sway but will lessen as QE reverses – something to keep an eye on. Access to the fine wine market is greater than ever before, particularly in the U.S., and continues to grow.

As ever, I would be delighted to hear from you to discuss any of this, or anything else wine related. I am happy to help and advise on your portfolio or cellar, for investment or drinking purposes. And now we can go out again I would be delighted to share a bottle!

Miles Davis 02/02/2022

by Wine Owners

Posted on 2020-12-09

Miles Davis, Wine Owners December 2020

As we head into the final phase of this extraordinary year, the world of wine investment is a calm and beautiful little side water, gently ebbing and flowing with that serene feeling it knows where it is going.Traditional assets continue to bounce around, no doubt causing palpitations and stress. More than ever, this year has been about timing in the capital markets, and if you got that wrong, the chances are you got it expensively wrong. Not so for vino! Unlike after the global financial crisis, the wine market has held its nerve, merchants did not mark down prices and the market has been stable. Investors are about, and even Bordeaux prices feel like they are firming up. Collectible assets are in vogue and it is easy to see why given these circumstances. You cannot even hold, let alone drink, a bitcoin, a share, a derivative, an option or a future and a bottle feels good, especially in lockdown!

Demand from Asia has increased and merchants trading the big names have been pleased with activity levels in recent weeks. There is almost a feeling there is an element of restocking going on after a quieter than usual period (in Asia) over the preceding months. This has happened in a period when the currency has gone against dollar buyers, although only marginally. Buying is very specific but certain names have moved up considerably since the middle of the year, Mouton ’09 and ’10, for example, are both up c.10%, the controversial ’03 c.14%. There does not appear to be any thematic buying, however, so it is not possible to call a vintage, or a certain Chateau or producer. Keep looking for the relative value is my suggestion and do not forget to make use of the useful tools we provide. See below for an example (if anyone would like a demo on how to use this, please ask):

In Burgundy, especially in the trophy sector, if it is not in its original packaging it is not going anywhere and vice versa. We have seen big ticket items in Leroy and Cathiard sell well recently. Provenance is key and is proving valuable.

Piedmont, Super Tuscans and Champagne remain firm, as does my conviction as areas for further purchasing.

We have had a lot of demand for Penfolds products; whether that continues given the newly slapped Chinese tax on Aussie wine imports will be interesting to observe but, in the meantime, we have plenty of two-way activity.

Personally, I have never been able to compute the prices of some of the ‘Cult Californian’ wines but, in fairness, I have rarely tasted them. Not so for that wonderful producer that is Ridge; the wines are lovely and the prices reasonable, in normal fine wine language, and a total give away compared to some of the ‘cult’ counterparts. We have offers of the flagship, Monte Bello, on the platform of the ’10, ’13 and ’17 that I would happily recommend, to anyone!

**************************

We have been busy at Wine Owners, with a lot more trades going through, spread amongst an ever-increasing group of followers. We are at record levels of new subscribers and have £300k of fresh offers in the last week alone. Notwithstanding the difficulties of some warehouse operations presented, our back office is working well, and our post trade analytics improve all the time.

On that bullish note, the team and I would like to thank everyone for their ongoing support. For those who have not yet fully engaged, we look forward to welcoming you soon.

Have a very happy Christmas, a wonderful new year, and drink as well as you can!

Miles Davis, 8th December 2020

by Wine Owners

Posted on 2020-11-12

Miles Davis, Wine Owners November 2020

There is not much to report on for October. The market continues to be very steady, gently rising in fact, and lacking in volatility – we are leaving that for the traditional asset classes and for those with a strong constitution!

The Covid related news had been sending shivers down the spines of stock markets as we here in the UK were heading into our second full lockdown of the year, only for that to turn around swiftly on the good news on vaccines.

The platform was busy in October, however, with good demand from Asia. Bordeaux indices have even been positive although overall market share remains weak. Sterling had been a little weaker during the month and this normally speedily converts into demand for Bordeaux blue chips from Asia. We have seen continued demand for Italian wines and Champagne with red Burgundy more mixed. Top end white Burgundy priced sensibly soon disappears from the platform and liquidity in this sector is perhaps stronger than it has ever been.

Champagne is the focus of the month and there could even be unprecedented Christmas demand this year if lockdowns ease and families and friends are once again allowed to socialise!

The recent release of Taittinger’s Comtes de Champagne 2008, which receives a fabulous write up from William Kelley of the Wine Advocate and 98 points, was met with great interest. There’s plenty of supply right now but given time there is plenty of room for price upside given the level of the ’02 now. Here is the relative value chart:

Obviously ’06 is the cheapest here but that, nor the ’04 vintage, quite carries the same stature of the fabulous ’02 and ’08 vintages. Having said that and given the quality of the juice we are talking about, Relative Value Scores at 30 or above look good in any book!

Generally speaking, I like the lower production levels of Pol Roger’s Winston Churchill Cuvée. In fine wine terms, Dom Perignon and Cristal produce vast quantities but are truly international brands and therefore trade at premiums to other names. Comtes falls somewhere in between.

Here are some price and point comparisons of the names discussed here, from really good to excellent vintages.

Overall, I would not put anybody off buying these wonderful wines for the medium to long term, they have years of life ahead and plenty of upside potential as they become rarer and rarer – and more golden!

|

| | Vintage | Price | WA Score | Price/Point (WA) | VINOUS Score | Price/Point (VINOUS) |

| Dom Perignon Champagne | 2002 | £127 | 96 | 1.32 | 97 | 1.31 |

| Dom Perignon Champagne | 2004 | £107 | 92 | 1.16 | 95 | 1.13 |

| Dom Perignon Champagne | 2006 | £108 | 96 | 1.13 | 95 | 1.14 |

| Dom Perignon Champagne | 2008 | £110 | 95.5 | 1.15 | 98 | 1.12 |

| | | | | | | |

| Louis Roederer Cristal Brut | 2002 | £213 | 98 | 2.17 | 94 | 2.27 |

| Louis Roederer Cristal Brut | 2004 | £160 | 97 | 1.65 | 96 | 1.67 |

| Louis Roederer Cristal Brut | 2006 | £130 | 95 | 1.37 | 95 | 1.37 |

| Louis Roederer Cristal Brut | 2008 | £158 | 97 | 1.63 | 98 | 1.61 |

| | | | | | | |

| Pol Roger Cuvee Sir Winston Churchill | 2002 | £167 | 96 | 1.74 | 96 | 1.74 |

| Pol Roger Cuvee Sir Winston Churchill | 2004 | £127 | 95.5 | 1.33 | 93 | 1.37 |

| Pol Roger Cuvee Sir Winston Churchill | 2006 | £117 | 95 | 1.23 | 96 | 1.22 |

| Pol Roger Cuvee Sir Winston Churchill | 2008 | £140 | 97 | 1.44 | 95.5 | 1.47 |

| | | | | | | |

| Taittinger Comtes Champagne Blanc de Blancs | 2002 | £166 | 98 | 1.7 | 97 | 1.71 |

| Taittinger Comtes Champagne Blanc de Blancs | 2004 | £96 | 96 | 1 | 96 | 1 |

| Taittinger Comtes Champagne Blanc de Blancs | 2006 | £73 | 96 | 0.76 | 95 | 0.77 |

| Taittinger Comtes Champagne Blanc de Blancs | 2008 | £117 | 98 | 1.19 | 96 | 1.22 |

by Wine Owners

Posted on 2020-10-06

Miles Davis, October 2020.

7min read.

Given the lack of relatively significant news in the wine market, this is the first report since early in the second quarter of the year.

In fact, it is fair to say that the world of fine wine has been relatively boring, and in this world, boring is good! The lack of volatility has been impressive. The WO 150 index has (rather surprisingly) posted a gain of c.%5 this year but that should come with the caveat that the constituents are older vintages and not the most liquid.

In the aftermath of the 2008 financial crisis, the major wine indices (predominantly Bordeaux led) fell sharply (c.25%) as market players and stockholders marked down prices, desperately trying to reduce inventory. The relative newcomer, China, was busy buying all the Bordeaux it could at the time and was presumably a little surprised by this sudden easing of prices – after all, what did wine have to do with the financial markets??

Anyway, Bordeaux prices rebounded quickly and from early 2009 to mid- 2011 witnessed one of the biggest rises in prices this market has ever seen, followed by a sustained bull run for, the recently discovered by China, red Burgundy. Unlike 2008, the Covid-19 infested world of 2020 is yet to lead to a global banking crisis, but the economic effects will surely be felt for some time and some easing of prices would not be surprising; yet in the world of fine wine prices are not being marked down, and the indices are largely flat. There is no panic and this is good. As you would expect, liquidity isn’t great, spreads are wider, and there aren’t many merchants buying for stock. Overall, the volume of wine (number of bottles) traded has increased although there are widespread reports of the value being lower – hardly surprising.

Here’s the WO 150 vs. the FTSE in the last ten years:

Other than a reasonably successful 2019 en primeur campaign, of which more later, Bordeaux has maintained its trend of recent years - its market share continues to slide. In August it hit a new all-time low of 35%, according to our friends at Liv-ex. Ten years ago that number was 95%! It is still easily the most liquid market, however, and that should not be forgotten in times of stress. Lafite and Mouton Rothschild still dominate Asian demand but long gone are the days when the prices just kept on rising; they are flat.

The 2019 Bordeaux en primeur campaign was highly unusual, in many respects. Not only did it happen in lockdown, it happened, apart from the locals, without any but the top wine journalists tasting any of the wines – unheard of! We decided to listen more to Jane Anson (Decanter) and James Lawther (jancisrobinson.com), both based locally, than other international critics after reports of samples being abandoned on melting driveways and being flown around the world in a rush; it just seemed more prudent. The consensus, however, or whatever, was that it was another fabulous vintage and even came out with the highest average scores in fifteen years – no mean feat. The other strange thing that happened was that some Chateaux priced the wine attractively. Prices needed to be 20-30% below 2018 prices to sell through and some were. The leading names for relative value and quality were the Lafite (including L’Evangile) and Mouton stables, Pontet Canet, Palmer, Canon and Rauzan Segla. The campaign came as a much-needed boost to Bordeaux’s flailing reputation, but it took some extreme circumstances to bring it about. In terms of wine, Bordeaux is doing nothing wrong, it is the pricing that is the issue.

The super-fabulous-amazing 2016 Piedmont vintage has been dribbling into the market, some via the grey market European trade and some from agent releases. Given the general mood, these have been easier to accumulate than in a non-virus savaged world and without an organised primeur release. Who knows how well these wines would sell if you had all the merchants shouting their virtues from the rooftops at the same time? Three wines, all with 98 points from Monica Larner that make sense and that I have bought are: Cavallotto Bricco Boschis (£260 per 6), Elio Grasso Gavarini Chiniera (£375) and G.D. Vajra Bricco delle Viole (£360). Luciano Sandrone’s Le Vigne 2016 was awarded the magical three-digit score (ML also) which sent the price from c. £550 to £1,250 before settling at around £1,100 now. From the same estate, Aleste (formerly Cannubi Boschis), with a mere 98 points, makes sense at £650. The official U.K. release from Roberto Conterno will be in October and although they are not yet scored, I have been accumulating in the grey market. They have decided not to make Monfortino in ’16 as it’s not the right style (!!??), which can only leave Cascina Francia as one of the buys of the decade, but what do I know?

As readers know, I am a keen fan of Italian wines for the portfolio, particularly Piedmont and Tuscany and wines from here can easily take greater supporting roles. The lead roles of Bordeaux and Burgundy have never felt more questioned. Super Tuscans are well developed in terms of the market and continue to do well, other Tuscan wines to a lesser degree. 2015 and 2016 were epic years in Tuscany, as we already know, but the ‘16 releases of Brunello are still to come and there will be opportunities ahead.

This interplays with the theme of new areas becoming more accessible and more interesting. The rise of the new world continues gradually as the depth of this market grows. Wine knowledge is on the up, price transparency and trading channels are ever more abundant, so competition from other areas is bound to increase. Quality from everywhere is on the up and the international market is flourishing.

The Champagne market deserves more on the limelight too. Here is the ten-year chart of the WO Champagne 60 index, a smooth 9% annualised, with barely a bump in the road:

Burgundy is in a funny place right now. The froth has definitely been blown off the top end of the market, even before the pandemic struck and the usual suspects do not just fly out of the door anymore. There is still demand for DRC, but it needs to be in OWC. Buying is to order, not for stock, and prices need to be sharp to attain a sale. The performance of collectable white Burgundies has been greater than their red counterparts recently and this is a very interesting area. Buy top quality producers at an early stage and do not hold on too long – the fear of premox has not disappeared entirely!

Keep an eye out for South African wines, mainly for the drinking cellar at the moment, but quality and media coverage are on the rise.

Any questions, please let me know.

Good drinking!

Miles

by Wine Owners

Posted on 2020-02-13

Miles Davis, 11th February 2020.

January in the wine world is always dominated by the latest Burgundy en primeur campaign. All the major Burgundy traders host tastings and the great and the good of the Burgundy buying world descend on them, hoping to make the latest ‘discovery’. Tastings this year were from the bumper 2018 crop. It was a very warm and sunny vintage with sunlight hours breaking new records. There were a lot of higher than average alcohol levels around and full, fat and juicy wines! There was plenty of merchant hype with generous descriptors in full flow. I found that seasoned pros were less impressed. The single most interesting fact surrounding the campaign, to my mind, was that one of the biggest merchants was only buying to order and would not be taking any wine for stock. Is this a sign of the times (i.e. the market) or the vintage? I think it’s a bit of both.

As previously described here, the wine market has been under the influence of a fare few geopolitical factors of late. That theme continued in January with the outbreak of the coronavirus in China. Given the proximity of Hong Kong to the outbreak, this is a further blow to the territory and the wine trading scene. Residents are working from home; confidence is low, and demand is thin.

Demand from the U.S. continues to be muted as we expect a further announcement from their administration regarding the Airbus related European tariffs on February 18th. Monsieur Macron has agreed a truce with Mr. Trump, for now, on his digital tax, but although that has gone away no one is placing any bets right now - the merest whiff of a tariff is enough to keep importers at bay. Here is a fascinating (and alarming) table of numbers from the American Association of Wine Economists, clearly showing the impact of U.S. tariffs:

I cannot explain the significant increase in New Zealand and South Africa versus the equally surprising declines for Argentina, Australia and Chile but researching the potential in South Africa is very much on my list of things to do!

Back in old London town merchants are discounting in increased margins to move stubborn stock and the traffic of e-mail offers has been on the rise. The market is desperately short of good news (the ‘Boris bounce’ lasted a full five minutes) and the signs are beginning to tell.

We have now seen releases of Giacosa and Sassicaia 2017. The Giacosa releases included the Barolo Classico, Falletto and the Barbaresco Rabaja from the mega 2016 vintage but the big one, Falletto Vigna Le Rocche Riserva, was from the 2014 vintage. Monica Larner of the Wine Advocate awarded 97 points and wrote “This estate is known for taking its biggest chances in the so-called off vintages. Betting on 2014 has turned out to be a brilliantly contemplated move”. I bought the lot, in all formats, in a brilliantly contemplated move!

I also bought some Elio Grasso 2016s (c. £350 per 6) and magnums of the Runcot Riserva 2013s. This is full blown 100 pointer from the Wine Advocate and only c. 5,000 bottles are made in only the very best years. This grower is becoming more popular and now he holds a perfect score is likely to become more so. One for the notebook.

I wrote very recently that if I had to pick one brand for 2020 it would be Sassicaia – the commentator’s curse! Following superb reviews and having won various awards for the ’15 and ’16 vintages, with price performances in the secondary market to match, Sassicaia has gone and done ‘a Bordeaux’! At £850 per six, this is a 22% increase on the 2016 release price, for an inferior vintage with an inferior score in a troubled market. Priced more modestly this could have sold out in seconds and left the crowd baying for more. As it is, it is very easy to buy at £850 – I prefer back vintages.

More generally, the WO platform has seen a lot of really good quality offers recently. There is a lack of confidence in the short term, collectors are trimming but there are buyers about; they just tend to be playing a bit more hardball than before. Spreads have widened in reflection of this and sellers need to be realistic (not over ambitious) if they want to sell.

Miles Davis, Wine Owners February 2020

by Wine Owners

Posted on 2020-01-16

This article is a follow up to our 2019 year end round-up by Miles Davis, published on the 10th January 2020.

The outlook for 2020

The geopolitical climate will continue to dominate the fine wine market in 2020. Uncertainty continues to hamper confidence amongst wine traders and although our view that the robust long-term fundamentals of wine will play out, there are some short-term issues (more on these below) that need to settle. If these issues, some of which are very specific to the wine market, can settle, we will look back on 2020 as the year of opportunity. Physical assets are doing well, gold is at a seven-year high, and we live in a climate of negative real interest rates. Stock markets are trading at all time highs and there is liquidity in the system, it’s just not finding its way into wine right now. Wine has been underperforming these other assets recently (one-year performances), see here:

The fine wine market continues to develop and change, and is becoming more interesting, with different fundamentals developing for individual markets, making them more autonomous all the time.

A whole new and significant factor is the U.S. and its trade tariffs, not only treating wines from different countries differently, but Champagne differently to still French wines, and wines above or below 14.1% alcohol from the countries on their hit list. Tariffs will influence the underlying markets, so until we have further clarification it is difficult to predict what may happen next.

As a result, I expect the wider market to start the year a little unsure of itself. There are and will always be opportunities within the wine market, however, but perhaps portfolio allocation has never been more important, producer too. And maybe more important than both of those considerations, are prices and relative value. Buying on the bid side of the market will be the key and good buying will be richly rewarded.

A reminder of performance over a five-year period:

I continue to favour Italy, particularly Piedmont and some of the super Tuscans and vintage Champagne. 2016 was an amazing vintage for Piedmont and new releases of Barolo should be considered. Of the major markets, I am generally lukewarm on Burgundy, but keener on Bordeaux where some fantastic older vintages, particularly ’89, ’90 and ‘96, are more available on the market than for some time. I think there will be some amazing opportunities this year in this area. I maintain my view that younger Bordeaux is fully priced, especially block buster vintages of ‘05, ‘09 and ’10 where supply is still plentiful and prices are high. I would be highly selective and very price sensitive in California and other ‘lesser’ investment markets, and always on the look out for lower levels of alcohol.

If I had to name one brand to buy this year it would be Sassicaia.

The issues in 2020

Brexit

The election result in the UK cleared the UK air after a period of uncertainty and it appears that producers and importers are relaxed, for now, about any Brexit impact.

Tariffs

The possibility of further U.S. tariffs has taken the place of the Brexit uncertainty but the situation there will become much clearer in mid-February, but I cannot believe anyone is going to be brave before then. If the tariffs remain as they are, I think the market will react in a positive way, negatively if they are any more punitive. The fact that the tariffs are only levied on wines under 14.1% alcohol, and thus wines stronger than that are exempt, is largely ignored by the market as an overriding sentiment takes over and the damage is done. Only wines from England, France, Germany and Spain are currently subject to these measures, making the rest of the world, particularly Italy in my view, look more interesting in the short term. France has particularly annoyed the U.S. with its digital tax aimed at the big tech companies and Champagne, given exemption last time round, may be in the firing line. But who knows what is going to happen next on this issue – the uncertainty is somewhat paralysing.

Hong Kong

The situation in Hong Kong is also creating uncertainty. The people are scared about the future and feel strongly enough to risk life and limb in protest, and China is not happy. The protests have calmed down from their most violent but there were heavily populated demonstrations at the turn of the year. Last week Beijing replaced their H.K. liaison officer with a senior and trusted aid of President Xi, hardliner Luo Huining, who ominously says that “everyone eagerly hopes Hong Kong can return to the right path." He comes with a reputation for fixing tough problems for Beijing!

The situation is complex, and it is likely the impasse will run and run. China can afford to be patient; it is sitting with the stronger hand and can probably slowly strangle the territory into submission without using undue force. Hong Kong has a long history of migration (especially post Tiananmen Square) and the numbers from now on will make interesting reading. Mainlanders are currently arriving at the rate of 50 a day but how many are leaving? Ultimately, I expect a huge number of democracy loving, wealthy locals will be leaving before 2047 but that this is the dawning of a new era for Hong Kong.

As well as being a lively wine hub itself, Hong Kong has been and is the gateway to China for fine wine and houses a lot of the experience and expertise in the region. More than ever, personnel and the location of businesses are transferable, and Hong Kong may lose market share in the longer term. This does not affect the long-term demand for wine, just where and how it is traded. If China was to open Shenzhen as a free port, for example, the impact would be immediate, and Hong Kong would be shunted sideways.

Other themes and points of interest

Bordeaux

The overall share of trade in the wines of Bordeaux has continued to decrease and the 2018 en primeur campaign was another damp squib. 2019 is another good, possibly great, vintage but the Bordelais need to respond accordingly if they want to stop the rot (how many times have we heard that!??). Young Bordeaux wine is still in a state of over supply with warehouses packed; a new lease of life is urgently required and if the Bordelais, by lowering prices, can take advantage of the huge media machine of en primeur to capitalise, they have a chance to turn the worm. I believe they have severely undervalued the power of the en primeur message over the years – we live in hope!

Climate change

Apart from the devastating fires we have seen in the U.S. in recent years, and Australia very recently, what does climate change mean for fine wine? Although winemakers are learning new techniques to deal with warmer weather the obvious and irrefutable consequence will be higher alcohol levels. Bordeaux 2018 demonstrated this in spades, with most wines well above 14%, and some around 15%. Although a lot of these wines can be well balanced, where the riper, more generous fruit copes with the higher alcohol levels, it does not take away from the fact there is a higher level of alcohol, and that’s not good. Most people, but especially connoisseurs, would prefer their wine to be around 13%. Other than the obvious benefits of scarcity, this is another good reason to favour older wines, they tend to be less alcoholic. I remember 2010 recording higher alcohol levels than we were accustomed to and causing quite a stir at the time - they seem perfectly natural now.

General (more for drinking)

South Africa has been receiving some very good press in recent times and quality is improving. It maybe not yet offering wines for investment, but it is certainly worth dipping a toe. I recently bought Meerlust’s Rubicon 2015 following some massive reviews, for not much money, for example.

Piedmont has had a string of good vintages, and there’s a lot of great quality Langhe Nebbiolo and Barbaresci on the market. Produttori del Barbaresco 2016s are both excellent and good value. Prices for these types of wines are the equivalent of generic Bourgogne.

Climate change is good for Beaujolais. The Gamay grape is a tough little number that needs plenty of sun and warmth. There has been plenty of investment in the region and quality and the number of wines providing pleasure is on the up. Do not overlook the versatile Chardonnay from the area either, a leaner style in general compared to the Maconnais and further north.

2018 Burgundy will provide plenty of easy pleasure but don’t believe all the hype from the merchants. Check alcohol levels, there are some that are too warm but in the main they, especially the reds, are generous.

Try and understand the critics and their scoring. At the Judgement of Paris in 1976, the range of scores, out of twenty, came in between two and seventeen. Some of today’s critics don’t really start at anything below ninety three (out of one hundred) and famous producers in half decent vintages are all north of ninety five. Big scores sell wines and are commercially attractive for nearly all involved – they just don’t necessarily reflect the truth! It has all gone way too far and this observer, for one, has had enough of it.

Wishing you well for 2020!

As ever, if you have any questions or would like to discuss anything wine related, do let me know.

by Wine Owners

Posted on 2019-09-09

August was much like July with summer holidays being the prime concern for most people. The wider market has felt quiet, maybe because the Bordeaux market is still largely flat, but there are definitely pockets of excitement about and the broad-based Wine Owners Index was up 0.9%. Trade was brisk with Piedmont, Tuscany and Champagne dominating turnover at Wine Owners.

The solid, relative value investment case for the wines of Piedmont has created demand which, in turn, has led to us step up our sourcing efforts. Liquidity is tight, obviously one of the plus points in the investment case, but we have managed to unearth some lovely parcels, particularly some legendary Bartolo Mascarello vintages.

Sterling has remained weak due to the Brexit shenanigans, and this has finally translated into some positive moves for various wine indices. As we know, a weaker pound generally leads to increased demand in the sterling denominated secondary fine wine market, especially from U.S.$ based buyers. Little has come out of Asia, however, as continuing rhetoric surrounding the U.S./China trade wars rumble on and Hong Kong is still suffering from the most vocal political protests in its modern history. They (the people of Honk Kong) have even appealed to Mr. Trump to help!

The largest region within the wine market will always be Bordeaux and it is business in the wines of Bordeaux that is suffering the most from these continuing issues. Many of the other top wine regions are less affected by these global events and market conditions as the wines are less traded, and the supply and demand ratio in a different place. Bordeaux has been looking cheap versus its peers for some time now, and there’s a lot of bad news in the price but the stars need to start aligning. This can and will happen, but when is the big question!

by Wine Owners

Posted on 2019-08-20

A brief and holiday interrupted report for activity in July

The wine market continues to hold its breath. Boris fulfils (what somehow now feels like) his destiny and moves into Number 10 and the pound plummets. It has since recovered a bit but even so, the wine market didn't flinch. As we know, a weaker pound generally leads to increased demand in the sterling denominated secondary fine wine market, especially from U.S.$ based buyers, but maybe not during the hot days of summer? Certainly not when the U.S./China trade wars rumble on, the rhetoric becoming ever stronger, and most definitely not when Hong Kong explodes into the most violent scenes of pro-democracy protest in its modern history. The Brexit backdrop adds to the confusion, so no wonder little happens.

The largest market within wine will always be Bordeaux and it is business in the wines of Bordeaux that is suffering the most from this continued malaise. Many of the other top wine regions are less affected by these global events and market conditions as the wines are more scarce, with the supply and demand ratio is in a different place. Bordeaux has been looking cheap versus its peers for some time now, but the stars need to start aligning. This can and will happen, but when is the big question!

Despite these almost stagnant overtones, trade has never been brisker with July setting a record level of turnover. Numbers of users, bids and offers forever grow. Collectors looking to trim positions have been well accommodated by others adding and reorganising their cellars, something we are seeing a lot more of.

Burgundy continues to look for its feet, Champagne and Super Tuscans gently hum along nicely, and we’ve seen a little demand for some of the new world too.

Here at Wine Owners, Barolo dominated trading in July. Many vintages of Bartolo Mascarello changed hands, also many Bruno Giacosas, Riservas and otherwise. Fratelli Alessandria becomes ever more popular, as does Luciano Sandrone. And there were some big-ticket trades in Monfortino and Ca d’Morissio.

Miles Davis, 20th August 2019

miles.davis@wineowners.com

by Wine Owners

Posted on 2019-07-08

The highlight in June for the wine world was clearly the Daily Telegraph event ‘Wine; for profit or pleasure?’. A sell out crowd witnessed excellent talks from four leading experts from the wine world, including two of us from Wine Owners (Miles and Nick). Please contact us for a copy of the presentation.

Otherwise June was again tranquil with trade bobbing along just fine but with no particular surges or dips anywhere. Global stock markets enjoyed a rise after Messrs. Trump and Xi found some accord but this doesn’t seem to have inspired the wine market as yet! Wine stock levels are healthy amongst Asian traders so not even a continuing depressed sterling is bringing about much marginal demand from that corner although most indices are in positive territory in June.

The Bordeaux en primeur campaign came to an end with an almighty whimper. En primeur gets under the skin of the wine trade and all involved spend far too much time talking, writing and moaning about it…yet even so, I shall continue! Within the wine market(s) it has represented very poor relative value for a decade, prices are just too high, yet merchants don’t dare turn their back on this once great provider. It was a great system for all involved, including the man on the street. Now only a very few wines ‘work’ each year (whereby they make sense to the supply chain and the end buyer). And now, to compound the problems of high prices, the Chateaux have decided to retain more and more of their own stock. How this comes to market, when and at what price will fuel debate but based on the evidence of the mighty Chateau Latour, the market may just turn its back. The feeling of stock overhang may easily outweigh the feeling of short supply and it’s not as if the world is going to go thirsty, there will always be alternative choices.

If only our Italian friends came together with a synchronised offering, we could have a proper old school primeur market again. All the market players would have to be involved at the same time, jostling for position, scrapping over every six pack and would still be able to sell at a price that would make everyone happy. The hype that the merchants used to create in Bordeaux primeur markets, that we are still hungover from, could be regenerated. We all miss the hype and the excitement which created such fear amongst the white-faced, panic-stricken collectors and consumers who couldn’t possibly stand even the faintest whiff of FOMO (fear of missing out).

As it is, Italian releases come to market in no organised way and importers and merchants release when they feel like it. It’s all very Italian really but it does make buying easier. We have been acquiring some 2015 Barolo new releases from Fratelli Alessandria, whose reputation is markedly on the up. Prices are very reasonable for these high scoring wines, ranging from c.£35 per bottle for their basic Barolo (94 Wine Advocate points) to nearer £60 for their top cru, Monvigliero (96+). Outside of the very top group, Luciano Sandrone is another producer worth mentioning - consistently high scores at affordable prices. Their equivalents in quality in either Bordeaux or Burgundy would be far more expensive.

Piedmont is easily our favourite region at the moment, due to the demand/supply equation and the blue chips remain well bid. Whilst Bordeaux and Burgundy remain lacklustre, Champagne and Rhone have attracted some attention. There is no question we would recommend the brilliant 2008 vintage in Champagne and the recently released Sir Winston Churchill looks a good bet with the ’96 being double the price.

Please see the Blog for more articles about the wine investment market.

Miles Davis

8th July 2019

miles.davis@wineowners.com

by Wine Owners

Posted on 2019-06-07

The wine market in May was completely dominated by Bordeaux en primeur. Overall the market is steady but lacklustre, ongoing concerns over U.S. and China trade wars and boring old Brexit rumble on and even a weaker GBP hasn’t managed to inspire substantially more marginal demand from USD based buyers. The secondary blue chip Bordeaux market is solid but a little stodgy. The bids are there but nothing much is moving north. As a result it is little surprise that merchants’ 2018 Bordeaux offers, backed by some exuberant critic’s reports and scores, have been flooding the inbox.

For our Bordeaux 2018 ‘in a nutshell’ report on the 2018 vintage, please click here.

Obviously the more exuberant critic reports and scores, of which there are (too?) many, have been the ones used by merchants and their sales teams. Julia Harding MW, of JancisRobinson.com, provided the reviews most in common with our own team’s appraisal and her scores are more subdued than others. She lends perspective to a vintage that we do not regard as highly as 2016 and one that may turn out to be overblown in some quarters. Antonio Galloni of Vinous Media is another commentator in the less exuberant camp and we look forward to his colleague Neal Martin’s commentary when it arrives (Neal did not taste en primeur this year due to ill health – we wish him a full and speedy recovery).

A very important point regarding the ’18 vintage, largely ignored by the salesmen and one I would like to repeat, is that whilst certain wines are very impressive, incredibly concentrated yet well balanced, they are really, really BIG. Nearly all of the alcohol numbers are between 14 and 15%. The poor unsuspecting punters may get quite a shock when they sit down, sometime from now, to enjoy their excellent claret only to discover they have something they weren’t quite expecting in their glass!

It'll be fascinating to see how the wines from 2018 develop as wines, but also from a market perspective. The Chateaux are holding back more and more wine every year and in some cases, releases are up to 50% lower than last year. Will this drive some scarcity seekers to market or will it have the opposite effect of creating a nervy overhang? It is fair to say that so far, Latour has not exactly flourished since retreating from the age old system. En primeur to my mind, apart from a certain few every year, has not made clear financial sense for years and few releases have come close to our ‘proto-prices’ (where the price needs to be to make clear financial sense to buyers), more here on JancisRobinson.com.

Successful releases so far include: Calon Segur, Canon, Carmes Haut Brion, Lafleur, La Mission Haut Brion, Leoville Las Cases, Pichon Lalande, Pontet Canet and Rauzan Segla. The majority of releases have not sold through.

In other areas there is still plenty of demand for high end Burgundy, it’s just that the prices that are being achieved by sellers are well below advertised levels. Piedmont is in good health but in low supply, a good thing for holders! Champagne holds firm, so do Super Tuscans.