by Wine Owners

Posted on 2021-11-22

For a couple of days at least the world felt normal again as the English wine trade returned en masse to Burgundy for the first time in two years. How wonderful it was to be back was the most prevalent sentiment and ‘ooh, aren’t the wines good’ the most repeated phrase. The Burgundians are a little more patient than their counterparts from Bordeaux and wait for a little over a year, as opposed to a few months, after harvest to show their wines to the world, making en primeur tastings that much more informative, and pleasant, so here’s a quick review of Burgundy 2020.

2020 was another very warm and dry year but the range in temperatures between night and day and the ongoing improvement and knowledge of how to handle the heat meant the vintage is a good one, a very good one. The whole winemaking process is more scientific and exacting than ever before and the attention to detail demonstrated by some winemakers is incredible. Whether it is more work in the vineyard, including the lighting of candles in the vineyards at four o’clock in the morning to stave off potential frost (or not as it turned out for Cyprien Arlaud of the eponymous domain in spring this year), harvesting earlier, new technology and/or machinery including a million-euro bottle washer machine (at Domaine Lorenzon in Mercurey), or organic or even bio dynamic farming these guys are giving themselves every chance of making great wine whatever mother nature throws their way. It was noticeable that bio dynamic farmers reported less loss of crop due to frost than others as their plants are healthier – at least that is what they say! Another technique favoured by some to avoid frost damage is to prune closer to springtime whereas traditionally pruning of the vines took place in November. This means they can control budding more closely and not leave the new buds exposed for longer. This has helped some growers enormously.

The devastating frosts of earlier this year (2021), particularly for Chardonnay, will be discussed repeatedly during the impending 2020 campaign in January, as growers will be factoring their lack of supply for next year into prices for this. Apart from the odd pause for breath Burgundy prices have been on the rise significantly for well over a decade now and there is no reason to suggest this will cease anytime soon.

There is just something very special about Burgundy; it appears there are just more aficionados plugged into this region than any other. Perhaps it is because it offers so many world class wines in both red and white, from two of the world’s favourite grape varieties, that no other region can compete with it in quite the same way. Release prices are going up and wines in the secondary market will continue to rise. Demand for all top end Burgundy is insane but the supply shortages of white coming up are going to impact prices heavily.

In brief, the whites from 2020 were picked early and characterised by mineral driven intensity and focus, not quite as fleshy as ‘17s, but fresh and zippy and generous too. Red berries were smaller than usual, with thick skins producing wines of good concentration and structure, bursting with fruit flavour and with early picking acidity was maintained.

Producers visited: Domaine Sauzet, Domaine Lorenzon, Domaine Chavy-Chouet, Domaine Ballot-Millot, Domaine Launay-Horiot, Domaine Duroché, Domaine Henri Magnien, Domaine Georges Noellat, Domaine Thibault Liger-Belair, Domaine Arlaud Pere et Fils, Domaine Marchand Tawse

For me the standouts were Sauzet, Duroché and Arlaud.

Bottle of the trip: Chambolle Musigny, Domaine G. Roumier 2017

Take aways from the trip: The quality of Thibault Ligier-Belair’s Morgon and how few people in the wine trade have ever been to Beaujolais!

The epic combination of Epoisses and red Burgundy (apparently, it’s ‘a thing’ but we didn’t know).

Many thanks to Flint Wines for organising the itinerary and to Cuchet and Co. for driving. Nice to see Albany Vintners, Brunswick, Decorum Vintners, FMV, IG Wines and Uncorked.

by Wine Owners

Posted on 2019-02-07

The broad-based WO 150 Index was flat for the month, as were nearly all the indices. The only real note of interest was the Burgundy Index, dropping by 0.7%. As you can see from the graph below it has been the stellar performer amongst the great wine producing regions of the world. It’s far too early to start calling a general cooling off period but as I have been arguing here it feels right to top slice some of the better performing names and start looking for some laggards.

The numbers in the box below are performance numbers over a five-year period, so all very respectable but nothing comes close to Burgundy. The consistency and lack of volatility must surely be a thing of beauty to the investor and connoisseur alike?

January is a busy month in the wine world when the latest Burgundy vintage is sold ‘en primeur’. 2017 was a decent vintage (See WO Blog) and has sold through pretty well given another year of testing prices.

The ‘Southwold group’ met in January to review the now in bottle Bordeaux 2015 vintage and there are two excellent reports on the three day session to be found on Vinolent.net and FarrVintners.com. In brief summary, ’15 is maybe not quite the excellent vintage that was first pronounced, certainly when judged by ‘English’ palates but still pretty damn good with some show stoppers therein. At the end of the Farr report there is an interesting table of recent vintages in order of perceived quality.

Here at Wine Owners we are betting more heavily on the ’16 vintage (not yet included in the Farr report) which we believe will move very close to the top of the leader board. Messrs Martin and Galloni of Vinous Media have recently reviewed the 16s in bottle and are waxing lyrical. Our very own meteorology and Bordeaux expert called the ’16 vintage some time back - pre the en primeur tastings even! All subsequent tastings and encounters of the vintage have confirmed our views and we are confident enough to shout BUY. What and when is a much more interesting question - so please get in touch to hear our thoughts.

by Wine Owners

Posted on 2019-02-04

As a couple of recent posts have alluded to, we think some of the really top end Burgundy has reached heights that might not be sustainable in the short to medium term. Over the last decade or so the Burgundy market has been the star performer:

But in the last year it has gone into interstellar overdrive:

Obviously Burgundy, and particularly the greatest names, are in short supply and the desire to have a slice of the action has had a dramatic impact on prices. But can this continue - THAT is the question!? This commentator has already sold some of the spectacularly performing big names and is reallocating the assets lower down the ladder, especially where prices are yet to move.

Last week we compared values of Clos de Beze 2010 from the Domaines of Rousseau, (Bruno) Clair and Drouhin-Laroze, all very closely rated, to find their respective price ratios to be 1 Rousseau for 13 Clair for 28 Drouhin-Laroze. This highlights the incredible disparity between certain growers and of course there will always be premia for certain names. However, the gaps have widened and some of the differentials are unjustified - opportunities abound, inter Burgundy and elsewhere. This quick comparison of a few random names suggests the currently less fashionable 1st Growth Bordeaux and even serious Rhone could be worth a look:

Please get in touch if you would like to discuss the Burgundian Conundrium and see if we can make sense of it!?

by Wine Owners

Posted on 2019-01-31

Domaine Bruno Clair, Chambertin, Clos de Beze 2010

WO Score: 94

Price: £3,120 per 12

Note from Burghound (93-96 points):

A spicy, pure and admirably refined nose offers up notes of cool, layered and an impressively broad mix of wild red berries, stone and underbrush hints. The textured and almost painfully intense broad-shouldered flavors possess deep reserves of tannin-buffering dry extract as well as the same extraordinary finishing depth that the nose hints at. A knock-out but this is expressly built to age and the flavors and tannic spine are so tightly wound that it's pointless to buy this if you do not intend to age it for at least 10 to 12 years first.

Domaine Drouhin-Laroze, Chambertin, Clos de Beze 2010

WO Score 96

Price: £1,410 per 12

Note from Burghound (93-95):

A spicy, ripe, elegant and admirably pure nose offers up notes of anise, sandalwood and clove that add breadth to the floral, earth and stone-suffused aromas. There is the same superb breadth to the rich, intense and tension-filled full-bodied flavors that possess excellent power and drive on the seductively textured, muscular and classy finish.

Both the Drouhin-Laroze and the Bruno Clair expressions of Clos de Beze from the blockbuster 2010 look attractive at current levels with the less fashionable Drouhin-Laroze really standing out - there are a few cases in the market too. Both get great scores across the board from the critics and have not kept pace with the sizzling Burgundy index (Drouhin-Laroze in light blue) over the last three years:

Whilst seeking high quality wines that have lagged the Burgundy market, these two have popped up as good candidates. More and more market watchers will be searching for this type of opportunity, so some catch up is expected. Neither have hit their drinking stride yet but when the scarcity kicks in, will it be possible to source them when they do? I doubt it.

Although it is not comparing like with like, Rousseau’s take on this famous piece of dirt, (rated at 94-97) at £40,000 per 12, is probably fully valued and I for one would be making a switch! Putting it another way you can buy 28.5 bottles of the Drouhin-Laroze product for one of dear Monsieur Rousseau’s! The Clair to Rousseau ratio a more modest 1:13, but still!?

by Wine Owners

Posted on 2018-12-17

Ahead of the new 2017 releases in early 2019 it's time to report on Burgundy and its news.

2017

Another warm summer produced accessible, fruity wines.

Left to do their thing, the vines were wont to produce very high yields especially in areas hit by frost damage in 2016 as the plants strove to compensate. Yields in Chardonnay were as high as 80 hl/ha. Now that’s a lot.

With a long run of short harvests stretching back to 2009 for several communes, the temptation was to let nature’s abundance run unabated. The trouble is, pinot noir is particularly susceptible to a large crop, so the trick in 2017 was to work to constrain yields.

Just as many over-cropped 1999s are now showing flat, far from being the great wines they might (and should) have been, we shall see which producers in 2017 haven't applied the brakes hard enough in due course.

For those who produced normal yields, 2017 is a delightfully juicy, fruit-forward year. Yet the best wines have more than just fruit: there is a fine mineral structure, a chalkiness and salinity that complements the raspberry coulis, kirsch, griotte, plum and fruit pastille characteristics.

The best pinots show appealing sucrosité with plenty of supporting freshness, which contributes to a sappy, mouth-watering persistence.

Above all I loved the harmony, balance, progression and energy of the best reds. I wouldn’t be surprised if they never shut down, and stay delicious from early on in their development throughout a moderately long drinking window: after all the 1997s are just about still hanging in there these days, and the 2017s have the potential to be rather better.

The perfect 2017 pinot has flowing raspberry fruit, a vinous, kirsch-like refinement, an infusion of Seville oranges and hints at a darker side with liquorice and spice.

The question mark over 2017 is whether a proper degree of intensity has been achieved. The vintage doesn’t seem to reach the same level in general as 2016, and yet the greatest 2017s do rival (and in a few cases surpass) their 1 year old siblings.

2017 is also very much a vintage where the appellations are reflective of their classification. Stepping up through a range from Bourgogne, through village wine and premier cru up to grand cru feels like an exercise in stepping up through the gears, with more oomph and interest at each change.

Whites are generally delicious as long as yields were tightly managed, and though the acidity levels were apparently a little less than in 2016, the very best still show a notable pithiness, a chalkiness and a bright intense citrus core that successfully counterbalances a tropical fruit character of pineapple and guava.

2018

Looking ahead to 2018, this is going to be a very tricky vintage. It was really hot, and the choice of picking date will have been critical.

Many producers were searching for perfect phenolic ripeness, waiting until the pips indicated an expected level of maturity. Some producers believed that perfect phenolic ripeness was not the only deciding factor for picking a harvest date in 2018. Those that were concerned about alcohol levels went early. They got their grapes in as early as the start of the last week of August finishing during the first week of September.

Producers needed to avoid too much extraction in 2018 for fear of introducing bitter flavours, especially those who had gone early. The gentlest of infusions seem at this very early stage to be the making of the best wines. Even so you won’t see many wines straight out of barrel with that trademark shining ruby robe of classic burgundy in 2018.

The most exciting wines tasted from barrel were made from grapes carried in at around 13.5 degrees but there are tales of 15 or (even!) 16 degree behemoths, whilst 14.2-14.5 degrees feels like a norm in the vintage.

The early pickers were fearful of what might happen if they let the alcohol levels rise too far, and they were evidently right. There were very real risks of partially completed fermentations and consequent high residual sugars in the juice. Several producers we spoke to had a battle to restart stalled fermentations, typically by tipping in the lees of another wine that had completed its fermentation more successfully.

The wines are largely dark purple or purple-black, opaque in appearance, and unsurprisingly show exuberant New World fruit and tend to have a mouth-coating texture due to the higher alcohols. There are some who argue that this is a very great vintage in the making; that vintages like 1947 were very hot indeed and yet they have transformed into great old bones. Taking a necessarily broad view at this early stage I would suggest that there are likely to be a rather small number of potentially very great wines.

Amphorae

Fourrier continued experimenting with Amphorae in the 2017 vintage with La Combe aux Moines, but they are sure to come into their own for 2018. The terracotta enables the wine to breathe whilst acting as a totally neutral vessel. This accentuates minerality and produces a wine – if unblended with wine aged in wood – that would be too strict. Certain of his wines including Clos St Jacques and La Combe aux Moines have a proportion of the production being aged within these fabulous looking clay containers for the 2018 vintage. The finished wine will be blended with the other part of First floor in barrels. It will be fascinating to see the results – could these turn out to be some of the greatest wines ever made at this wonderful domaine?

2017 – The year that distribution changed

Producers are not blind to the fact that certain merchants have been selling their UK en primeur allocations to Asia, notably Hong Kong. They are not happy to discover that importers cross geographical boundaries, even if the wines sold may be subsequently stored for a period of time in the UK.

Nor are their agents impressed, who have the clout to recommend their producers shift allocation to where demand is currently being met indirectly.

As a result certain top producers have withdrawn a significant part of their allocation to the UK in favour of Asia, even though there is much more wine this year to go round - in some cases up to 3 times the quantity of 2016.

2017 pricing

With Brexit uncertainty depressing the Pound, more wine not necessarily translating into larger allocations for the UK, and the secondary Burgundy market having risen substantially during the course of 2018, there are few reasons to imagine that prices will fall. Which makes it a tricky call for consumers who don't want to lose their allocations and yet this is one of the most uncertain of times. High release prices for great vintages such as 2015 and 2016 were swallowed. We will have to see how digeste 2017 proves to be.

by Wine Owners

Posted on 2018-10-22

Omar Khan’s Business & Wine events are hedonistic epics of wine indulgence and learning, and October 2018’s event at The Four Seasons on Park Lane was no exception.

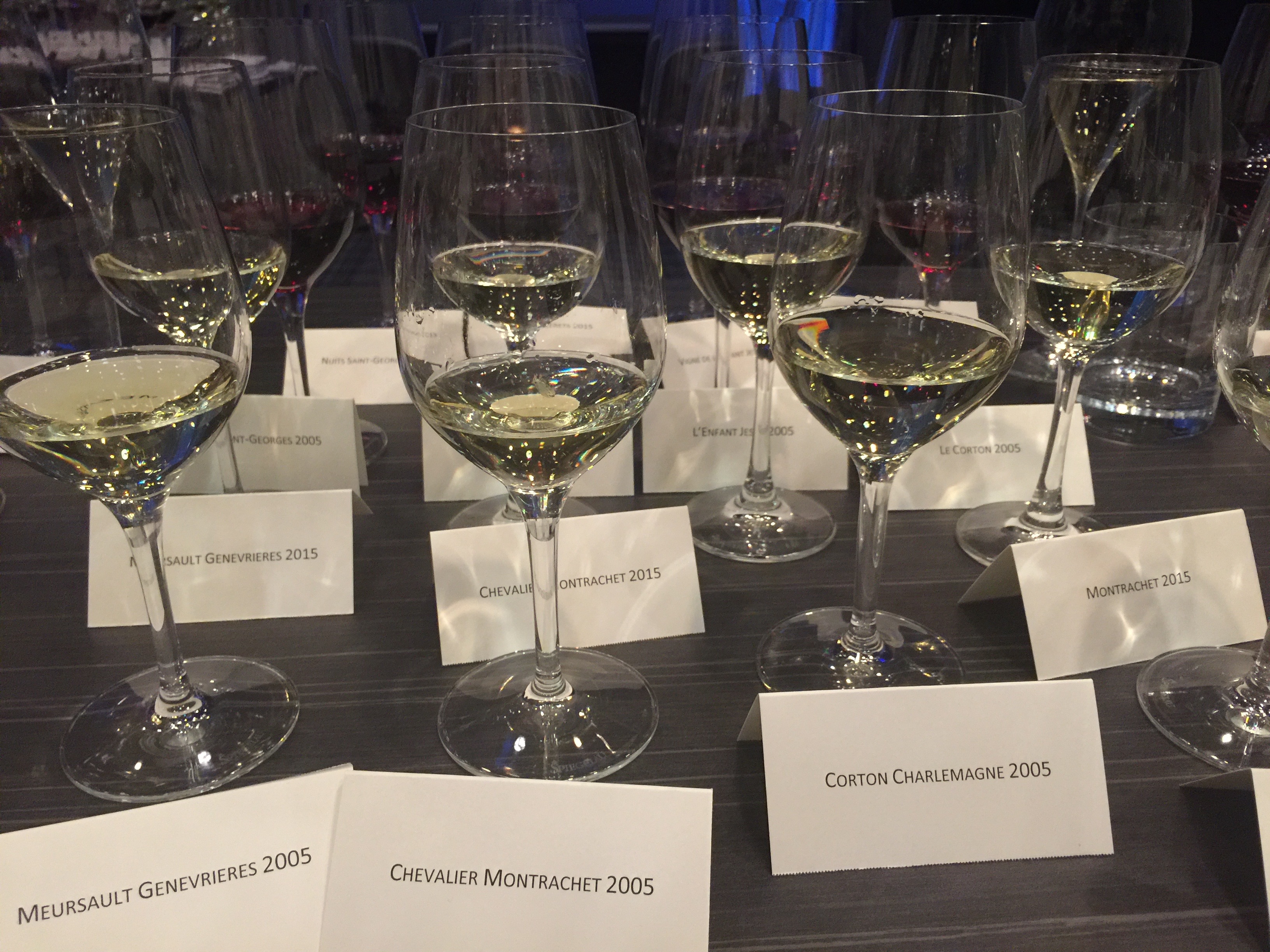

Bouchard’s 2005s are a stunning set of wines, and when compared with 2015 showed fabulous balance and freshness. A beautiful menu that proved a perfect foil to the great wines served including Chevalier Montrachet La Cabotte 2002 and Beaune Greves La Vigne L’Enfant Jesus 1976 demonstrated how unfair Michelin can be in its treatment of hotel establishments compared with independent restaurants: Romuald Feger deserves a couple of stars!

By the time Henriot bought Bouchard Pere et Fils in 1995, the venerable House, founded in 1731 had found itself in a bit of a financial squeeze. New oak barrels were rationed and the wine maker was making do.

Herriot’s purchase changed all of that, and by 2005 Bouchard was well and truly reestablished as one of the great Burgundy Houses, and a microcosm of Burgundy itself with vineyard holdings representative of practically every commune across the Cote de Beaune and Cote de Nuits. The responsibility of this unique heritage is keenly understood by Henriot: so that for consumers discovering Burgundy, whose initial enthusiasm can so easily be diverted by an underwhelming experience, Bouchard Pere et Fils offer a swathe of benchmark wines.

Tasting a cross section of the 2005 Burgundies compared with the 2015 vintage highlighted a number of exceptional terroirs. It also showcased the very high quality of the 2005 vintage. It may well be that 2015 was a much more successful version of 2009, with the warmth of the vintage kept fresh and with retained definition of fruit thanks to more controlled wine making, but on this showing the wines are less precise and less fresh than 2005. Maybe they just need more time; sometimes the intrinsic balance of a wine changes shape over the course of the early years in bottle. Let’s hope that’s the case with these 2015s because the whites in particular need to freshen up.

A little more on the 2005 vintage chez Bouchard. These are, in a word, brilliant. We suspect most Burgundy-philes have resisted broaching their 2005s for fear of encountering a tannic behemoth, such are the tales of untamed structure in the top wines. This range tells a very different story: of freshness; blood orange mid palates, confit fruit illuminated with beaded acidity, and the sort of drive and energy that makes you want to dribble into your poulet de bresse aux tropettes de morts. Of course there’s structure too, but it’s balanced, provides focus and is more than offset by oodles of rich juicy fruit.

Ot the reds L’Enfant Jesus showed the precision of the Beaune Greves vineyard, with a bright thrust of energy, resonance and depth, and a mid palate veined with blood orange and black chocolate. This is a wine for the ages.

Le ‘Le Corton’ is a great red terroir, produced from a vineyard which is also permitted for white Corton. This 2005 doesn’t have the earthy depths of a Bressandes, but exhibits great drive, energy, a concentrated confit mid-plate and is very elegant. A more delicately formed Corton and in my view all the better for it.

Volnay Caillerets 2005 is a more forward wine, although the term is relative in context of the preceding wines. Aromatically spiced with a dark liquorice sweetened mid palate that has a creamy texture, a good sense of energy with oranges present on the finish.

On the night the Chevalier Montrachet 2005 was chalky and mineral, insinuating in its attack before gradually but determinedly building intensity. Very, very long. Le Montrachet 2005 was a powerhouse but so, so primary; a tough one to judge other than elementally and so to try to anticipate something extraordinary in the coming decades.

On this showing, other than recommending you fill your boots with Bouchard 2005s, you might want to check if 2005 Burgundies are well enough represented in your cellar. If not, they’re not going to get any cheaper as they get closed to the start of their drinking windows, so now’s as good a time as any to start looking for some.

by Wine Owners

Posted on 2018-06-28

Whilst expensive Burgundies make the headlines, there's another revolution taking place that is transforming the qualitative level of winemaking more generally in Burgundy.

Revolution

It's a revolution that's very different to the one caused by an influx of corporate cash snapping up top domaines that produce some of the region’s most sought-after wines.

Daughters and sons who are graduating from l’école viticole, and who spend their stages at new world wineries or with progressive in-region vignerons, are taking best practises in the vines and chais back to familial domaines and transforming quality of those wines. Other offspring are going it alone, relying on their social network to buy grapes from friends and friends of family. And still others are coming back to their roots, turning their back on a career in Paris for the siren call of the Côte d’Or.

In a way there’s a relationship between the two; the big money coming in is offering the promise of a wealthier future to the next generation.

Must buys

Within this dynamic atmosphere there are lots of value buying opportunities. One doesn’t have to be a millionaire to own and to drink Burgundy. But you need to be quicker to claim an early allocation than previously. Prices of new discoveries rise fast. Whereas in the past it would have taken many vintages of successes before a domaine became established enough to justify rapid price hikes, these days positive press and ensuing price escalation can happen quickly.

How do I discover new producers?

Follow your favourite merchants – they’ll organise events or dinners at which the wines they represent can be tasted, allowing you to figure out which of the wines they are offering you think are the real deal.

Follow the critics – Neal Martin is now at Vinous, William Kelley has assumed the mantle at robertparker.com and Steen Öhman is busy discovering new talent at Winehog.

The blog format of Winehog is well suited to reading about new discoveries, where he’s picked up on Thibaud (Y) Clerget, Nicolas Faure, his fiancée Amelie Berthaut at Berthaut-Gerbet, Maxime Cheurlin at Georges Nöellat, Duroché, Jean-Marc Bouley, Arnaud Tessier, and Jean-Marc Vincent to highlight a range of notable domaines.

Charmes Dessus 2012, Domaine Tessier © Nick Martin

His latest discovery is Marthe Henri Boillot in Mersault, a true ‘start up’ having returned to pick up the remnants of her grandfather’s estate and has cut sourcing deals with friends.

It’s a familiar story. Down the road in Santenay Jean-Marc and Anne-Marie Vincent picked up the reins of his grandfather’s lapsed estate back in the late 1990s, and have transformed it into by far the best domaine of Santenay, making wines of great succulence, nerve and aromatic complexity. In fact, his reputation as one of the best true vignerons on the whole Côte is widely recognised by many other top producers all the way up into the Côte de Nuits.

They say birds of a feather flock together. Just look at Jean-Marc’s vigneron network, and you discover producers who share the same qualitative ethic and who are in search of constant improvements; producers such as Olivier Lamy, Jean-Marc Bouley and the passionately intense, super-fit Bruno Lorenzon in Mercurey.

Jean-Marc Vincent © Nick Martin

High density planting, low plant yields, vine training to minimise stress on the vine’s foot, braiding à la Leroy, soil microbial activity/ fertility, low sulphur addition late on in the winemaking process, rigorous triages of natural corks - are typical leitmotifs of these, and a growing number of young, ambitious producers.

In Vosne-Romanée, the brilliant and young family winemaker at Arnoux-Lachaux, Charles, has employed the braided training technique of his heroine Lalou-Bize Leroy to magical effect in his Aux Reignot vineyard, adding definition, an extraordinary energy and drive to this profound wine that is Grand Cru in everything but name. Arnoux Lachaux’s prices have skyrocketed so in that sense that particular ship has sailed; plenty are yet to leave port.

by Wine Owners

Posted on 2018-06-06

Hosted by Flint, tutored by Alec Seysses, this was an unforgettable dinner. The wines are hedonistic, show great intensity of flavour and grand dimension. But they are not heavy or dense. They are wines of intensity and breadth rather than weight.

2011 Bonnes Mares

Alec said that they extracted a little more than they might normally have done. The colour is a darker shade of purple, whilst at first the nose is dense and rather closed. There is a boatload of liquorice evident at entry and on the mid palate, with iodine, orange and thyme.

With air the nose opens up to reveal lavender and plum skins, a sweetly perfumed mid palate and a velvety texture. Great length. Complete.

93

1998 Clos de la Roche

At first a tight nose, with a sweet undercurrent. With time in the glass, classic tertiary pinot aromas mingle with lemon verbena. A fresh attack is followed by citrus fruit, and a sappy, mouth-watering mid palate. There’s great persistence to the finish with a classic pinot character. Showing plenty of life and suggesting a great mid term future over the next 5 years.

93+

1997 Echezeaux

Expansive nose of angelica, sandalwood and iodine. Quite broad, very tertiary, leafy and resolved with a medium-long finish.

92

2007 Clos St. Denis

Sherbetty nose, broad pinot nose, herbal and saline. Delightful fruity mid palate, redcurrent and cream, a touch of liquorice, sweet fruit but lifted by a gently freshness. Hedonistic.

94

2002 Clos St. Denis

Perfumed, deep nose, a hint of game with a consommé-like infusion, saline. That gamey complexity shows up again on the front palate before broad orange-infused flavours channel the wine into the mid palate. Terrific focus. Moderate weight but great intensity, very complex with an unami and saline character building out into the long finish. Very 2002 in its precision and energy.

98

1999 Clos St. Denis

Oranges and other citrus fruit on the nose, with lemon verbena adding a herbal character. Gorgeous velvety texture, a really visceral wine. Liquorice, orange pith, great intensity and a really solid core. Compact and immensely deep. Orange rind on the finish. Very young and tight as yet.

96

1999 Echezeaux

A pinot ‘qui pinotte’ – that classic nose exhibiting tertiary pinot character of strawberries ‘on the turn’ mixed with damp undergrowth. Just classic. Gentle resolved wine. Some resonance on the finish. Deceptively mid-weight with alluring intensity.

92

1999 Clos de la Roche

Great complexity and depth. Orange infused nose, saline with perfume of wild broom. Cloved, liquorice attack, and a hedonistic and visceral mid palate. Great resonance. Orange peel, sherbettty sweet fruit. Amazing freshness and length. Goes on and on. A legend.

97+

1999 Bonnes Mares

Expressive aromatic nose, really quite open and sweet. Ready to go, right in the middle of the red to black fruit spectrum. Fruity jujubes and as you might expect a sweet mid palate. Calmed down with 30 minutes of aeration in the glass to reveal a fresh finish that lengthens correspondingly.

93

Caroline Brangé ©Nick Martin

by Wine Owners

Posted on 2018-03-05

We would like to echo the sentiments of Lisa Perotti-Brown – the new face of Bordeaux at The Wine Advocate – who revels in reviewing great wines from vintages less hyped than the universally celebrated ones.

A review of past vintages is so much more pleasurable than one of a current vintage. It can be pursued at leisure, far from the madding crowd of en primeur set-piece campaigns. The wines have been in bottle for some years, and have grown into their skins, allowing them to express themselves and harmonise. There is none of the guesswork required when evaluating young wines. And it is not done as part of a tasting Megathon favouring the most obvious, richest wines…

Here follows a spotlight of vintages which hide truly great wines, many of which still represent good value.

Burgundy 2013

Let's start with 2013, the worst climatic year Burgundy has experienced in a long time, characterized by a dreadful summer of cold, sodden weather. But that’s the thing with Burgundy; its growers refused to give up. They never do. They spent the summer in their Aigle wellies desperately battling the filthy elements and sticky, sucking mud. Coaxing what they could out of their precious vines - their livelihood - trying to make the best of a seemingly bad lot. The coaxing process involved leaf thinning, and sacrificing bunches to give the rest a chance at maturing properly. And that is the thing with Pinot Noir; it responds exceptionally favourably to low yields.

Now, if you like dense, sweet fruit with generous alcohols, 2013 may not be the vintage for you. But if you enjoy intensity of flavour without the weight of a hot year, red Burgundies from 2013 will positively surprise you. All the more so if you first tasted barrel samples back in January 2015; the wines are now positively transformed from that first recalcitrant showing.

It’s well known that a warm, accommodating, crisis-free growing season will result in wines that are generous and velvety-textured in their youth. But these aren’t always the wines that develop into fine, complex maturity. Take 1999 for example, lauded as one of the greatest Burgundy vintages of all time. Indeed, some of the wines are astoundingly good. But just as many others are really quite average. Why is that? Over-generous yields. It’s a fine line with Pinot, between harvesting as much ripe fruit as nature provides and allowing the fecund vine to produce as much as it’s wont.

Back to low-yielding 2013, and the best wines are beautifully crystalline, intense and transparent. Think a cornucopia of red fruits, blackberries and gooseberries: the essential ingredients of a refreshing summer pudding – a balancing mélange of sweet and sharp. Add characteristic Burgundy high notes of salinity (and a mineral-tinged, geological nod-in-the-glass to the inland sea of which the Cote d’Or was once a part) and hopefully you’ve formed a fair mental image of 2013 red Burgundy.

It’s no coincidence that blue chip stalwarts such as Eric Rousseau and Christophe Roumier love their 2013s. Aubert de Villaine sees his Domaine de la Romanée 2013s as long distance runners (in contrast to his more ‘forward’ 2014s). And they are delightful.

2013 is also one of the last sensibly priced vintages before Burgundy prices became vertiginous.

Burgundy 2006

Wines from cooler Burgundy vintages often start out rather awkward, and out of kilter. Their acidity may add definition and length, but can also close the wine down, or conspire with tannins to suppress the essential grape characteristics in a wine.

2006 was one such vintage. Its wines were initially hard to taste, and broadly speaking, unlovely. Many of us viewed 2006 Burgundies as unwelcome magpies in our collector’s nest of more comely vintages.

But now, after a decade in bottle, the wines are starting to show very well. They exhibit well-defined fruit, great length and energy. Next to the 2005s, they may lack heft and powerful tannin structure, but they are nonetheless serious, intense wines. And they are beginning to drink well now. You’ll have to wait at least another decade for your 2005s to come around, but 2006 is a fine emerging vintage that will give pleasure now and for the foreseeable future.

Bordeaux 2011

For Bordeaux, 2011 was always going to be a tough sell. On release, the wines seemed scrawny and mean in comparison with the monumental 2009s and 2010s.

Yet a recent dinner event hosted by Wine Owners showed how dangerous it is to tar a whole vintage with the same presumptive brush, or to judge a more classic vintage too early. The highlights of that tasting were Vieux Chateau Certan 2011 and La Mission Haut-Brion 2011. They were both easily the equal of their counterparts from better-regarded vintages, and represent great value compared with any more recent vintage.

Bordeaux 2006

In Bordeaux, 2006 was a vintage that attracted more than its fair share of negative press, the effects of which are still in evidence today, judging by the affordability of 2006 Bordeaux on the Wine Owners Exchange. The success of a Bordeaux vintage depends on sentiment, and in 2006 combination of negative factors came into play.

First, it came on the heels of stellar 2005. Second, Bob Parker’s favourable rating of the vintage attracted criticism from many pundits, attracting further negative attention. Third, the release prices were too expensive– due at least partly to the high Parker scores. Why else would La Mission Haut-Brion be ready to trade at £1,550 per 12x75cl, yet be overlooked?

[ Top tip: buy La Mission Haut-Brion at this level – half of its opening (mis)price. It is considered a ‘wine of the vintage’, rivalled for this accolade only by the (much more expensive) Mouton. ]

We are fans of the Bordeaux 2006 wines we’ve tasted. They don’t have the powdery tannins and powerful black fruit of the 2005s, but they do have superb energy, and a sappy character that compels you to take the next sip. We see many wines from 2006 as more interesting than their counterparts from 2004 or 2008. Notable examples include Mouton, Pontet-Canet, Leoville Barton, Leoville Las Cases, La Conseillante (just a sampled tip of the iceberg). Whenever tasted comparatively, these showed extremely well alongside relative other vintages.

In our experience, where 2006 performs particularly well is its consistency. Simply put, we’ve never had a poor one. Other low-rated back-vintages produced a number of successes (such as 2007, 2011), but none are as consistent as 2006.

Bordeaux 2002

2002 is another Bordeaux vintage which suffered from poor reputation. The year’s poor weather consigned the vintage to the status of ‘restaurant wine’ before any of the wines were even bottled. But it’s easy to forget that the wines were very well priced; first growths were released at around £800 per case (just one-sixth of their 2015 release prices). If you had invested in 2002 Bordeaux 15 years ago, you would be feeling rather smug right now. 2002 is the vintage for the contrarian that lurks inside every wine enthusiast!

While they were never going to be the most profound expressions of Bordeaux (in the light of the meteorological conditions), the 2002s have consistently tasted savoury, fruity, and sweetly spiced with cloves, cinnamon sticks and liquorice root. At all levels of classification, we’ve yet to stumble across a disappointing example.

Piedmont 2002

In 2002 Piedmont, like Bordeaux, suffered from rotten summer weather. Wine commentators have described 2002 in Piedmont in such terms as ‘wiped out’, ‘disastrous’, ‘severely compromised’, ‘a washout’.

But despite all of this, one wine survived the vintage’s humid gloom (and the hailstorms which repeatedly strafed Barolo) with enough salvaged bunches to benefit from perfect autumnal conditions. This is a wine made with such severe selection that yields were just 12 hl/ ha, and which epitomises viticultural triumph against the odds. The wine in question is, of course, the now-mythical Barolo Riserva Monfortino 2002.

Take a moment to consider the sacrifice involved in making wine with yields as low as 12 hl/ ha. Burgundy considers 25 hl/ ha to be painfully low, and in Bordeaux anything under 40 hl/ha is a very short harvest.

Giovanni Conterno – Roberto Conterno’s late father – called 2002 the greatest Monfortino of his lifetime.

The last word must surely go to Antonio Galloni, whose tasting note and review of this wine encapsulates why it’s so rewarding to seek out the greatest wines within those vintages in the shadows:

“…the 2002 Barolo Riserva Monfortino, a wine that may very well turn into a modern-day legend… 2002 was a cold, rainy year that in many parts of Barolo culminated with violent hailstorms in early September. The weather then turned picture-perfect for the rest of the growing season, but by that time most vineyards were severely damaged. The late-ripening Cascina Francia was an exception. Conterno green-harvested aggressively, which gave the fruit a chance to ripen. …The Conternos were so upset by the poor early press reaction to the vintage they announced they would let no one taste their 2002 Barolo. Conterno has fashioned an old-style, massive Monfortino that pays homage to the great wines of decades past. …It is a deeply-colored, imposing Monfortino loaded with dense dark fruit that today is held in check by a massive wall of tannins…classic, old-style Barolo the likes of which we aren’t likely to see again any time soon. Antonio Galloni, October 2008.

by Wine Owners

Posted on 2017-05-24

With the 2015 Burgundies arriving in the market these days and with more to come over the next period the market is showing mixed signals - some of continued excessive demand and some spell disaster for lesser producers trying to claim high prices.

The prices of the 2015 vintage

The price development for the 2015s shows a rather mixed picture at the primary level - some producers have showed great restraint and have in some cases kept the prices at 2014 level, whereas moderate increases have been seen even amongst the top producers in very high demand.

A lot of Burgundy producers are aware of the dangers of high prices even on village level, as these wines are now becoming very expensive in restaurants. If they want to maintain a good representation in restaurants the prices for a village level wine are near the limit - aside from the producers in extremely high demand.

Other producers seem not very aware of these dangers and have increased the 2015 prices by more than 20% - and while this may be viable in the very short run - I have talked to several wine bars and restaurants that have cut allocations already, and many will do so after the 2015 vintage. This will perhaps not have a huge effect on the 2016 vintage as the quantities are very small in some cases .. but in the long run some producers have priced themselves out of the market so to speak.

The 2016 vintage - what to expect

I have tasted some 2016s already and there are plenty of reasons to be optimistic, as quality looks very fine indeed. The wines are cooler than the 2015s, and in that way more classic. It's still too early to be very firm on the quality - but potentially a quite outstanding vintage - very well balanced and enjoyable for both the reds and the whites.

The quantities are very low due to the April frost, but also very uneven across the producers and appellations. My expectation would be that the low quantity will ensure a continued upward pressure on prices for the wines in demand, but the tendency could be trouble ahead for increases in prices for the wines with no real demand in the secondary market.

Francois Millet, Domaine Comte Georges de Vogüé - Picture: http://winehog.org/

The long-term effect of prices

In my view, we will see continued increases in prices on the wines in very high demand - i.e. wines getting high prices in the secondary market thus ensuring a margin for those who buy the wines in the primary market.

These wines will still be in demand, as many people will keep allocations as it's a good investment, but larger share will eventually end up in the secondary market. Some of these wines are now priced beyond the limits of the average quite well off consumer, and will be traded accordingly. Restaurants will do the same, and as it becomes more difficult to sell the wines at the tables - they will also cash-in offering wines on the secondary market.

The wines not in demand in the secondary market will eventually have problems, as consumers will cut allocations and move on to other products.

This is where Bordeaux was 15 - 20 years ago, and while the top Bordeaux wines have managed to increase prices the lesser wines from Bordeaux are struggling with low demand and low prices even though quality and the value of these wines often can be tremendous these days.

Take a look at the wine lists of today and note how limited the Bordeaux offerings often are these days - compared to 20 years ago.

Burgundy will prevail but demand will be more volatile

With the small quantities produced in Burgundy the risk of a full meltdown is not imminent even with the latest increases in prices. Some producers will struggle as they will be caught between the need or urge to increase prices and the restrain shown by some of the top estates regarding the prices on the low-level wines.

A good negociant will be facing the fact that their Vosne village will cost the same as the wines from a top end producer in the primary market. That is not sustainable in the long run - and these producers could well see a collapsing demand within a few years.

As prices go up I expect demand to be more volatile, as the focus on the great vintages will increase. This has happened in Bordeaux and with the globalisation and available price information around the clock this will also be the case with Burgundy.

So, I expect increasing and more volatile prices for the wines in demand, and a sluggish market for the producers with high prices without a good demand from the secondary market.

The calculative consumer

As the prices increase the consumers will be more calculative and look at the historic prices and the development in the prices and availability of back vintages. Is it the right time to buy, can the same wine in an equally good back-vintage be found on the market at a lower cost.

The conscious consumer will check these things, and will search for information, to ensure a good price and ensure a good investment, even though the wine is bought for pure pleasure. Importantly consistency in the prices seen in relation to back vintages will be needed at least for wines produced in relatively large quantities.

This will increase the focus on services that offer historic data on prices and the possibility to validate and research the “true” market price.

The rising stars will emerge and shine brightly

Furthermore, we will see new talented producers pop up - and become in fashion within a very short time - and achieve high demand for these wines in the secondary market very rapidly as the producers get the acclaim from the wine press. So, exciting times where buyers and investors must be on their toes to follow the trends in Burgundy.

As a wine writer, it's exciting times in Burgundy as new talents emerge all the time, and old somewhat lacklustre estates are transformed to a new star within a few years with the arrival of a new generation.

So, stay on your toes, stay tuned in and informed on winehog.org - a yearly subscription is only 29€ - sign up here

Steen Öhman

Chief Tasting Officer

Winehog.org

NB:

The team at Wine Owners love Steen’s Burgundy reviews. Just like us, he was an impassioned collector, until he decided to pack in his day job and apply his palate to Burgundy for the good of mankind (and perhaps to gain a little personal enlightenment along the way).

An annual subscription with https://Winehog.org is a bit of a bargain; plus the reviews are accessible, and when we taste the wines that Steen’s tasted, we ‘get it’. Furthermore he’s a real discoverer, so if you're the sort of collector who loves the idea of buying into the next young Burgundy buck before the rest of the world catches on and spoils the price, you really should subscribe!