by Wine Owners

Posted on 2014-02-22

By Jean-Marc Vincent

Following a 2012 vintage of outstanding quality but with quantities commonly down 50%+, growers were hoping for a more bountiful 2013. Sadly it was not to be. Burgundian vignerons have had just cause to complain (regarding yields) since the start of the decade, with yet more reasons in 2013.

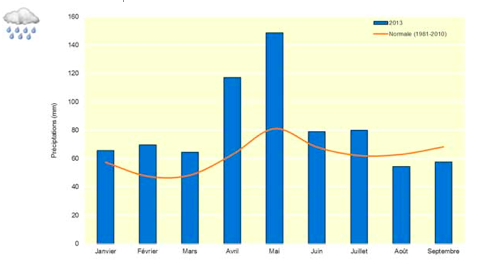

Winter had been long, spring was cold and rainy followed by an irregular summer of hot interludes interspersed with colder, wet weather. The harvest could only start at the beginning of October in most of First floors across the Côte d’Or.

A cold and wet spring had led to coulure and millerandage, with hailstorms proliferating the spread of mildew and oidium resulting in much reduced yields at harvest.

From North to South, no region was spared. Really low yields resulted in overall volumes equal to or less than 2012 (1.26 million hl). Fortunately the quality evident at the end of the harvest was good, even if far more heterogeneous than in 2012.

THE SEASONS

Winter started late. From January to March, temperatures stayed cool. The beginning of spring was also very chilly and prevented the vine from starting – causing almost 2 weeks of delay.

In early May, when the first buds finally appeared, heavy rains hit the region in waves. Plots from the lower slopes were totally flooded during the course of a week. Temperatures came close to causing frosts. We came within an inch of disaster repeatedly.

In June, the cold temperatures and rain were incessant, leading to a 3 week-late flowering. Coulure and millerandage reduced the crop significantly, at times by half. The hot, dry and sunny start of summer reassured and benefited the vine. It encouraged a good finish to the plants’ growth phase.

The last fortnight of July suffered from a violent storm in the Côte de Beaune (1,350 ha were hit on the 23rd of July). August was irregular and finally the ripening of the grapes kicked off.

September didn’t spare the the vines either. Mild temperatures and and regular rain led to rot (Botrytis ), which spared the well ventilated bunches of little berries in the case of pinot noir (millerands). The choice of the harvest date was to prove crucial. It was essential to wait for a proper maturity and then pick each plot really quickly.

THE WINES

The vintage was a difficult one and favoured the most serious, meticulous, and cool-headed! Vignerons who worked thoroughly back in May – the moment when those who took the necessary risks of making a small harvest for the 4th year in a row – will release high quality wines.

The low yields explain the quality-to-be of the best cuvées. The whites are taut but not agressive and have an amazing minerality thanks to a chilly month of August which preserved acidity, minerality and their aromatic complexity. The bunches of pinot noir were really millerandées (small berries which tend to proliferate on older vines), extremely wholesome and help explain the unexpected level of quality in such a cold vintage. At the best addresses, the reds are aromatic, showing freshness and length.

In the end, 2013 is promising to be a very classic burgundy vintage that should interest enthusiasts.

Jean-Marc Vincent is a brilliant, thoughtful, meticulous vigneron based in Santenay, who together with his delightful wife Anne-Marie, are producing fabulously pure wines that age beautifully at their tiny domaine. His 2012s are exceptional.

Original French version:

Après une année 2012 de grande qualité mais qui n’avait donné bien souvent que la moitié d’une récolte normale, les vignerons de Bourgogne espéraient une année 2013 plus généreuse. Et bien non! Les vignerons bourguignons n’ont pas fini de se plaindre du début de cette décennie et particulièrement de 2013.

L’ hiver a été long, le printemps froid et pluvieux suivi d’un été irrégulier ou des périodes de chaleur ont été suivies par un temps plus froid et humide. Les vendanges n’ont pu démarrer que début octobre dans la plupart des vignobles de Côte d’Or.

Un printemps froid et humide a entrainé coulure et millerandage, orages de grêle, attaques de mildiou et d’oïdium, ce qui a fortement réduit les quantités récoltées.

Du nord au sud, aucune région viticole n’a été tout à fait épargnée. De très petits rendements ont donné un volume égal voire inférieur à celui de 2012 (1,26 millions d’hectolitres1). Heureusement, la qualité, quoique plus hétérogène qu’en 2012 est souvent au rendez-vous à l’issue des vendanges.

LES SAISONS

L’hiver a été tardif en Bourgogne. De janvier à mars, les températures restent fraîches. Le début du printemps est lui aussi très frais et empêche la vigne de démarrer, avec au final près de 2 semaines de retard.

Début mai, alors que les premiers bourgeons apparaissent enfin, des pluies importantes tombent fréquemment sur la région. Des parcelles de bas de coteaux sont complètement inondées pendant une semaine. On frise la gelée et la destruction complète de récolte plusieurs fois.

En Juin, le froid et la pluie persistent, entraînant un retard de floraison d’environ 3 semaines. Coulure et millerandage réduisent la récolte considérablement, parfois de moitié. Le début d’été, chaud, sec et ensoleillé rassure et profite à la vigne. Il permet d’obtenir une bonne fin de croissance.

La deuxième quinzaine de Juillet est marquée par un violent orage de grêle sur la Côte de Beaune (1 350 ha touchés le 23 juillet). Août est irrégulier et enfin la maturation des raisins commence.

Septembre ne ménage pas les vignes. La douceur ambiante et les pluies régulières favorisent la pourriture (Botrytis), limitée sur les grappes aérées constituées de petites baies dans le cas du pinot noir. Le choix de la date de récolte est essentiel. Il faut savoir attendre une vraie maturité et ensuite vendanger très rapidement chaque parcelle.

LES VINS

Le millésime a été difficile et va révéler les vignerons les plus sérieux, les plus assidus et avec le plus de sang-froid! Tous les vignerons ayant fait le choix en mai d’un travail soigné et ayant pris le risque de faire pour la quatrième fois de suite une petite récolte vont signer des vins de très bonne qualité.

Le faible rendement va expliquer la qualité des meilleures cuvées. Les blancs sont tendus mais pas agressifs et bénéficient d’une minéralité exceptionnelle du à un mois d’août frais qui a préservé les acidités, les minéraux et même les arômes. Les grappes de pinot noir étaient très millerandées, très saines et expliquent un niveau de qualité inattendu dans un millésime aussi frais. Chez les meilleurs producteurs, les vins rouges sont aromatiques, avec de la fraicheur et de la longueur.

Au final, un millésime bourguignon très classique et recommandé aux vrais amateurs de vins de Bourgogne.

by Wine Owners

Posted on 2014-02-17

By Peter Adcock

Wine. For many people one of the great pleasures of life. A liquid that's been around for thousands of years and which today supports a multi-billion dollar industry worldwide.

For most, wine is a drink to be enjoyed. Whether we buy a few bottles each week at the local supermarket or are more serious about building a cellar to last a few years, we have one aim: to enjoy wine as one of the most versatile and varied of drinks.

In recent years increasing numbers of people have started to treat wine as an investment. On the face of it the steep rises in wine prices in recent years lends support to the view that wine makes sense as an investment. But does it?

It is probably true that most wine investors actually understand and enjoy drinking it! Quite often too they may be anti-other "risk investments": because wine is an actual physical asset perhaps they trust it more.

So what are the positive reasons for investing in wine?

1. Wine can be an excellent alternative investment which can be used to diversify larger portfolios.

2. Capital returns are free of all capital gains tax (CGT) making wine an attractive option for

investors who already use their CGT exemptions elsewhere.

3. The potential returns on sought-after wines can be spectacular. Until recently fine wine was

one of the best performing investments over the last twenty years.

4. Wine stored in a bonded [duty-free] warehouse doesn’t attract any VAT or duty until it is

withdrawn from the warehouse.

Potential Drawbacks

As with any investment there are disadvantages and perhaps its biggest drawback concerns its legal status. Investment in wine fall outside the remit of UK financial services legislation. This has two implications:

- Losses are not covered by the Investor compensation scheme, meaning there is no white knight coming to rescue you if your investment turns out to be worthless.

- Investors who consider they have been given bad advice cannot use the Financial Services Ombudsman to obtain redress. Legal action to recover money is at your expense.

Like other unregulated sectors, the lack of regulatory controls makes it easier for less soundly structured businesses to operate and indeed for some downright scams to take place. A recent example which affected some of our clients was quite simple really. Take one parcel of wine. Sell it to several different clients! Repeated one hundred-fold and you can see the potential scale of the racket. “Houses of cards” like this come tumbling down easily. This one did when the first client wanted to liquidate his assets.

The vast majority of wine dealers are reputable but like any business sector some fail while others do very well. If therefore you want to take advantage of the undoubted potential advantages of investing in wine therefore, how do you protect yourself?

Here are a few points to think about:

- Don't consider investing unless you have substantial investments and pensions elsewhere.

Because of its unregulated nature I generally recommend wine only where a client has at least

£250,000 invested in mainstream assets.

- Having decided to take the plunge, check out different ways of investing. These include the

bigger, well known wine merchants as well as newer specialist wine websites.

- Talk to friends and acquaintances who have invested. Who do they buy through? Why? How

and where is their wine stored? Be guided by recommendations but not to the exclusion

of other sources of information.

- Look for businesses with a proven track record for staying in the course.

- Having drawn up a short list of brokers/suppliers, interrogate them. What regions do they

invest in: are they sticking to "Classic France" or ranging further afield? If they make bold

claims for the performance of their investments do independent guides support these claims?

- From a legal viewpoint, check that your purchases are identified separately and that you hold a

certificate of ownership. Can purchases be identified separately at their place of storage?

- As far as possible check the business's financial status. Review their published accounts.

Crucially ask if client funds (you usually have to provide funds before wine is purchased on

your behalf), are segregated from general business finances. Don't be scared to ask for bank

statements and ask if the accountant audits this account separately to the business. If they have

nothing to hide they should have no problem in providing any of this information.

Like any investment (regulated or not), you cannot always avoid losing money when investing in wine. You can though make extremely good returns. Worst case: unlike any other major investment, if it doesn't work out for you at least you can drink your assets!

Peter Adcock, Financial Planner, Accountant, Founder of Adcock Financial, and fine wine lover.

by Wine Owners

Posted on 2014-02-10

I have to admit to an illness - if the invitation says from 8.30am, that's when I turn up. I hate to be late. After last Friday am I pleased to say that I am not alone; there are other people who obviously share this compulsion, or perhaps they just appreciate an empty tasting room to get on with the serious work of appreciating the craft of Burgundy's pre-eminent domaine.

And what a pleasure it was, to taste and to have the chance to hear Aubert de Villaine's thoughts as he carefully spoke to each member of the trade or journalist in turn. The wines that were so fruity to taste at the domaine, I learned, today were a little less forward in the basement of No. 1 Thomas More Street. These are not wines that march to centre stage and loudly speak their lines, they impress with a more subtle stagecraft; delightful gestures and gently spoken words that nevertheless hang in the air.

These are wines of finesse and haute couture perfume in 2011. As several fellow tasters commented 'this isn't 2010'. Indeed, but what these wines do possess is precision, elegance, and heavenly scents.

The other attribute they all share is freshness, none more pronounced than in the Grands-Échézeaux. A nose of bright redcurrents and damsons with a touch of white pepper preceded an entrance of finely-grained intensity, followed by a creamy character, and a sustained prickle of acidity braiding the lifted fruit. Is 2011 a minor triumph for Grands-Échézeaux more generally? I've had some crackers.

The Corton too, highlighted the freshness of these wines through a flinty, perfumed sea-breeze nose. Elegantly spiced, gently vibrant fruit leading to a lovely dry finish, suggesting a door closing but more to come the other side.

Those heavenly scents were expressing themselves without hesitation in the initially explosive nose of the Échézeaux, before calming into gently perfumed pinot fruit. A firmly bitter fruited palate carried through to an insistent finish. Nonetheless the most tender of the range?

The Richebourg's perfumed nose was altogether more powerful than any of the preceding appellations. An ever-changing, multi-faceted cloak lifting now and then to reveal subtle woody undertones. Here too was a cool edge but also a sense of the lip-smacking concentrated fruit to come. One of the most integrated on the palate, a fruit-liqueur-like texture ahead of the closed finish.

Romanée-St-Vivant had more of an ungiving nose in contrast to the others. The red fruit of the previous wines replaced by flavours in an altogether darker vein. Liquorice and hints of dark chocolate followed a tightly coiled entry, swiftly followed by semi-frais currents. Confit depth and a long and structured finish. I love tasting young Burgundy that gives you hints as to its future potential behind an elemental mask. How can one ever truly know, but surely this is going to be 'une bombe'?

La Tâche got me going with a mouthwatering nose - literally - of lifted, perfumed berries. The firmly fruited palate also expressed an underlying earthy mineral character, more grounded and masculine than the others. Dark fruits entranced and exited in turns. Very much on its reserve towards the finish.

Romanée-Conti seemed like a big jump up, as Aubert had said it would be this year. Extraordinarily richly-fruited nose, the perfume this time submerged by rising darker notes. Waves of fruit on the palate washed over a sweet intense core. The vintage's freshness then showed itself with a lift of vibrant red berries before, once again, the darker fruits took over on the finale.

Nick Martin

by Wine Owners

Posted on 2014-02-06

Average cellar size £60,000

Total cellars under management £40m

|

January |

Overall |

| Bordeaux |

26% of total trades |

39% |

| Tuscany |

23% |

12% |

| Rhone |

21% |

13% |

| Burgundy |

21% |

17% |

Enthusiastic reviews from Antonio Galloni seem to have piqued interest in the 2010 vintage in Tuscany and Piedmont, with back vintages in Tuscany hanging on the coat-tails of the 2010. The tried and tested Supertuscans seem to be the big winners, with trading users offering and bidding around Sassicaia, Ornellaia and Masseto in mid January, with a high correlation of offers to trades across the region.

The inclusion of some excellent new private collections of Rhone and Burgundy in December and January have pushed up the market share of those regions to rival Bordeaux in those months, with a spread of private and trade buyers picking up top wines from producers like Guigal, including a rare parcel of 1989 la Turque trading at £2,900.

Bordeaux, even in a relatively flat market for the region, continued to account for the largest percentage of Exchange trades in January. Interest focusses around classic wines such as 1982 Latour (recent trades at £13,300), top scorers, and ‘off’ vintages, particularly among the first growths. On the right bank in particular, 2005 appears to be attracting new interest where the price is right, so perhaps the prospect of an uninspiring En Primeur season is already encouraging sparks of interest in great vintages with a track record of quality and performance.

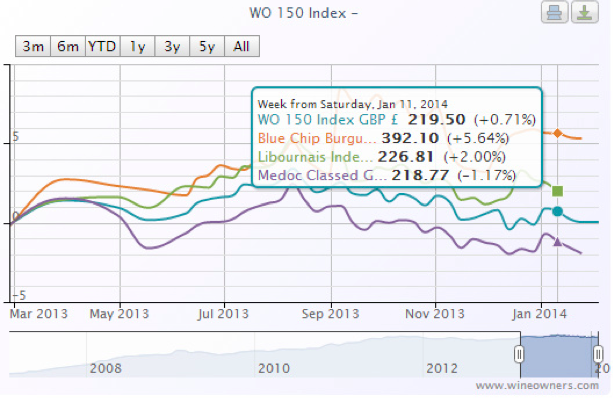

Index comparisons show a relatively flat year’s market, with Medoc Classed Growths slightly underperforming, and top level Burgundy slightly bucking the trend by showing 5.6% growth compared to a base value at Feb 2013.